ActiveCampaign adds entire Loop office to Chicago’s record sublease supply

ActiveCampaign adds entire Loop office to Chicago’s record sublease supply

Trending

“It’s a race to the bottom:” Chicago office recovery stalls

City records worst quarter in more than a year

Chicago’s office market has a hard-to-shake case of the hiccups.

As commercial real estate players work to stabilize from the pandemic’s decimation of demand, they’re finding out the recovery won’t be straight upward, as new obstacles impede progress.

The city’s total leasing dropped to its lowest level in more than a year in the third quarter, with transactions totaling 1.8 million square feet, according to a report from Savills. Plus, even more real estate was put onto the sublease market in the last three months, reversing course from earlier this year, when tenants had started to make a dent in the key metric of supply, to set a new record-high of 6.6 million square feet.

“This is not a Chicago phenomenon, it’s an everywhere phenomenon,” Savills’ Joe Learner said. “We’ll still have this relative sluggishness, which will manifest itself in large vacancies and this tenant-favorable marketplace will continue.”

Tenants who made deals tended to downsize, a common outcome of decisions made during the pandemic as remote work proved viable for many companies, at least part of the time.

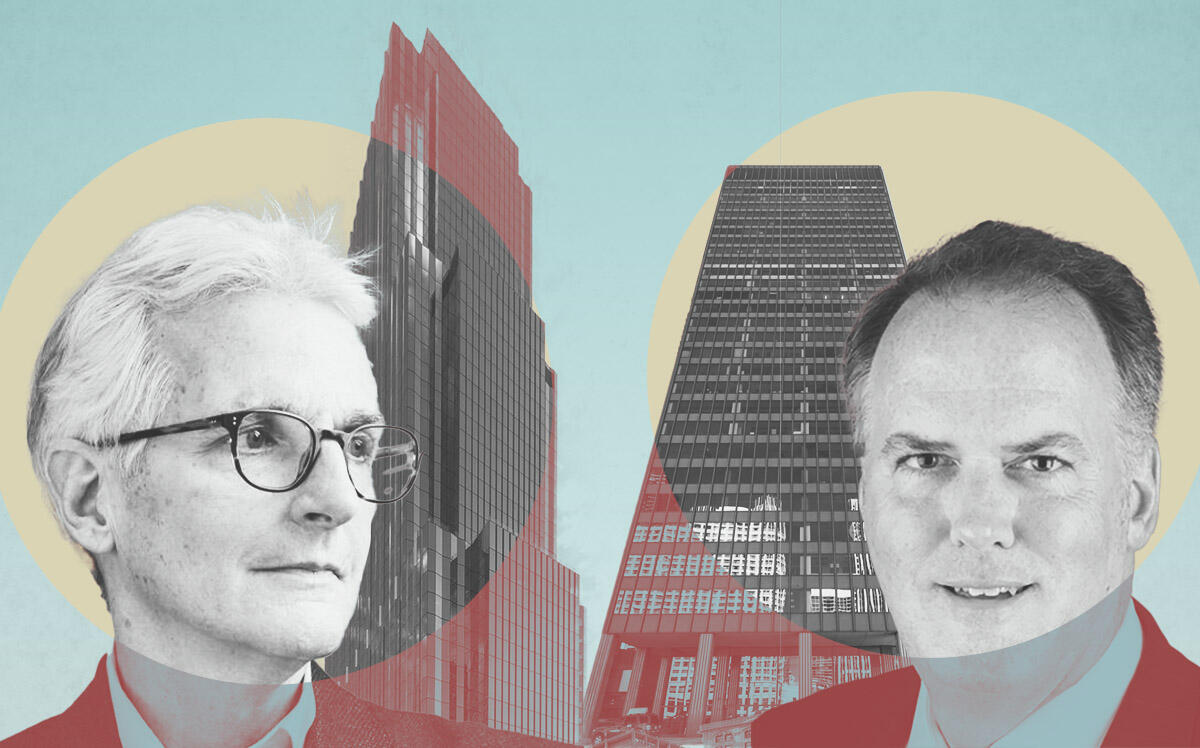

The National Futures Association struck a deal at Riverside investment and Development’s newly opened BMO Tower at 320 South Canal Street for 55,000 square feet, cutting its footprint by 22 percent from its current offices at 300 South Riverside Plaza, according to Savills.

After Cook County government leased a 101,000-square-foot new office location at 161 North Clark Street, the BMO Tower deal was the second-largest new lease of the quarter, reflecting the continuation of the city’s top tier of tenants considering only freshly built trophy buildings.

Supply in Class A buildings fell slightly to 19.3 percent, while it grew in Class B buildings by 70 basis points to an all-time high of 29 percent, Savills found. Availability across all building classes rose 210 basis points from a year ago to 24.5 percent.

“We started to perhaps see some light at the end of the tunnel, but then all the sudden the economy started taking a bit of a hit, costs of goods started going up significantly and there’s a potential looming recession,” JLL’s Matt Carolan said. “Because of all that, it’s creating extended amounts of uncertainty as companies are still trying to figure out their long-term real estate strategies.”

Vintage Chicago buildings still landed some notable new leases, proving they can bring in some noteworthy tenants following renovations to add amenities.

Despite the ongoing retreat from older properties, Beacon Capital Partners reeled in U.S. Soccer, the nation’s governing body for the sport, to its 30-story tower completed in 1979 at 303 East Wacker Drive for 33,000 square feet. The deal was struck after the Boston-based landlord bought the 944,00-square-foot property for $182 million in 2018, and put $35 million into building improvements that transformed the top level from windowless storage into a tenant lounge and fitness center.

Furthermore, energy company Constellation Energy took some space off the sublease market, renting more than 44,000 square feet in the Boeing building at 100 North Riverside Plaza, which the aerospace giant ditched as a headquarters to relocate its base near Washington, D.C.

Even with record sublease supply, tenants are encountering hurdles as they search for spaces that facilitate hybrid work environments, as some on the market were built out over a decade ago, when keeping desks for every employee was the norm, and they now require pricey rebuilds.

“The rate is too good to pass up as it’s a race to the bottom for a lot of these subleases with this much competition,” Carolan said. “They need to be very aggressive, but then those companies don’t necessarily want to come out of pocket with the capital expenses associated with retrofitting those spaces.”

Such deals kept Chicago’s total leasing volume for the quarter well-above the worst stretches of the pandemic in 2020. Yet landlords should expect to stay at a disadvantage. Macroeconomic factors — mainly inflation and the interest rate hikes central banks are instituting to battle it — are projected to keep decisions on commercial real estate coming at a slow pace.

“For numerous reasons including a wobbling global economy, continued weakened demand, and buildout construction costs, landlord concessions are expected to remain at or near all-time highs for the foreseeable future,” the Savills report said. “With quality sublease options at an all-time high, tenants will continue to hold leverage over landlords to secure more advantageous direct deals.”

Read more

ActiveCampaign adds entire Loop office to Chicago’s record sublease supply

ActiveCampaign adds entire Loop office to Chicago’s record sublease supply