Trending

The Boca buzz

UPDATED Dec. 19, 5:49 p.m. After eight years without any luxury development in Boca Raton, two condo projects kicked off their grand openings in December.

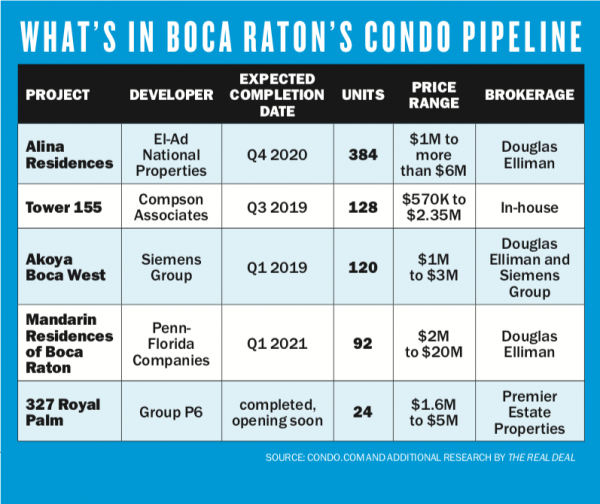

Group P6’s boutique condo project 327 Royal Palm and Siemens Group’s 120-unit Akoya Boca West are cutting their ribbons, making them the first condo projects to open in the city since 2010.

The last major condo project that opened in Boca, the 52-unit One Thousand Ocean developed by LXR Luxury Resorts & Hotels, closed out sales in September 2013, with a total sellout reaching a little more than $273 million. Announcements of new high-end condo residences have been few and far between since then.

“Now is the perfect time for us to launch,” said Noam Ziv, El-Ad National Properties’ executive director of development. The firm is developing Alina Residences, which is one of five condo projects slated to be completed in Boca by early 2021. Plans have been in the works since 2015, but the firm finally scored approval for Alina last year.

El-Ad is converting the former Mizner on the Green townhome community at 200 Southeast Mizner Boulevard into a 384-unit luxury condo project, with prices ranging from $1 million to more than $6 million. The first phase is underway and will consist of about 121 new condos that overlook Boca Raton Resort & Club’s sprawling golf course.

Getting in while the market is hot

As the area anticipates more inventory, highly competitive residential brokerages that have battled it out in Miami — and as far away as Los Angeles — are expanding into the city to vie for contracts. To get their foothold in Palm Beach County, these larger firms have been snapping up smaller firms that have labored to gain traction in the local residential market.

Over the past several months, both Douglas Elliman and One Sotheby’s International Realty have acquired smaller firms in Boca. Phil Gutman of Brown Harris Stevens said he’s also looking to open an office there.

Over the past several months, both Douglas Elliman and One Sotheby’s International Realty have acquired smaller firms in Boca. Phil Gutman of Brown Harris Stevens said he’s also looking to open an office there.

Rochelle LeCavalier, whose Boca brokerage, Pink Palm Properties, was bought by Douglas Elliman in July, said it took a couple of years to break into the market at the highly exclusive Royal Palm Yacht & Country Club. (See more on the recent spate of acquisitions on page 18).

“It was not an easy nut to crack,” LeCavalier said. “I dramatically underestimated how competitive it was going to be.” At the time — around 2011 — the dollar was at parity with the Canadian dollar, she said. So she found success by having her team of three connect with investors and private banking clients from eastern Canada, while she knocked on doors until she had about a half dozen lots under her control.

Pink Palm closed about $100 million in sales over the past four years, with a focus on the nearly 700 home sites within the 450-acre country club community, LeCavalier said, adding that prices there range from about $1.5 million to $15 million.

Douglas Elliman Florida’s chief operating officer, Gus Rubio, said Pink Palm’s representation of homes in the country club was one of the reasons the brokerage chose to buy LeCavalier’s firm. “We had a couple listings in the community, but didn’t really have a foothold,” he said.

One Sotheby’s International Realty also extended its reach to Boca Raton. In October, the Miami-based brokerage acquired fellow Sotheby’s affiliate Nestler Poletto Sotheby’s International Realty, a nearly 80-agent firm with offices in Boca Raton and Delray Beach.

Meanwhile, Mauricio Umansky’s Beverly Hills-based brokerage, the Agency, opened its doors at 20 Southeast Third Street in Boca Raton in early December as part of its expansion plan for South Florida. Managing partner Chris Franciosa said the firm “started to pay attention to South Florida’s development migration moving northward to Palm Beach County.”

The Agency’s entry point into South Florida is a newly proposed apartment project, 333 Victoria Park, in downtown Fort Lauderdale. The firm is consulting with the project’s developer, Global Dynamic Group, as the development moves through the approvals process and will handle sales and marketing for the units.

“[Boca Raton and Delray Beach are] not as overrun like in the Miami area, where the [market’s] volatility really goes up and down,” Franciosa said. “Inventory stability is longstanding in Palm Beach County; it has a healthy mix of full-time residents and second- and third-home buyers.”

Older players, new tricks

With the influx of new brokerages, established firms are faced with added competition.

Boca Raton-based Lang Realty opened in 1989 and has grown to a 339-agent operation in Palm Beach County. The firm ranked third in The Real Deal’s fall 2018 ranking of top brokerages in Palm Beach County, with an annual sales volume of $1.03 billion. Lang’s president and co-founder, Scott Agran, said it plans to open its 12th office next year in Boynton Beach.

Other brokerages already operating in the market include Premier Estate Properties and the Keyes Company, which in 2016 acquired Palm Beach County-based Illustrated Properties.

As old and new brokerages proliferate, sales prices are on the rise in Boca. The most recent Douglas Elliman reports show a 12.3 percent year-over-year increase in the median price of luxury townhomes and condos in the city, to $225,000.

But other brokers agreed that Boca Raton is not an easy market to enter. Some say it’s because it’s not as familiar to South American buyers as cities like Miami. Others believe there’s little room for price growth.

“Very few [brokerages] have been successful,” Agran said, declining to be specific. “People are finding that prices have gone up for the last eight years or so, but how much further is this market going to run?”

For now, he’s keeping a close eye on the coming cycle. “Long-term appreciation depends on the price points, how builders push them and if buyers buy them.”

Correction: An earlier version of this story erroneously stated that sales of units at Alina Residences were being handled in-house. Douglas Elliman is handling sales for the property.