Trending

Foreign buyers back — but no more ‘Irish carpenters’

<i>International apartment hunters in market again, but not likely to put a dent in the oversupply of condo inventory</i>

Daniela Sassoun of the Corcoran Group at 110 Central Park South, which has been popular with her South American clients.International buyers — perhaps the most overhyped group of boom-time property seekers — are back, brokers say, and they’re richer than ever.

While much of the meager sales activity in New York has occurred at the lower end of the market during the past year, experts say the new wave of foreign buyers now trolling for Manhattan property tends to be wealthier than previous foreign buyers, and they are looking for pricier real estate. That’s largely because the New York market is no longer as accessible to the working-class foreigners who invested in homes here during the mid-aughts. With mortgages rarely available to foreigners, international buyers must now often be able to plunk down the entire purchase price in cash.

That’s just one of the ways today’s foreign shoppers are different from their boom-time counterparts. These moneyed buyers are displaying vastly different preferences than their predecessors. For one, they’re more often users than investors, so instead of purchasing tiny studios sight unseen, they’re scouring the city for deals. Moreover, many are shunning new development Midtown high-rises in favor of resale condos, townhouses or even co-ops in the West Village or Uptown.

“It’s a completely different buyer than the buyer who was here in 2006 and 2007,” said Daniela Sassoun, a vice president at the Corcoran Group who is originally from Brazil. “This buyer is more sophisticated.”

An influx of cash-rich buyers may sound like exactly what Manhattan needs to reduce the excess inventory of new condos on the market, but it’s not quite that simple, experts say.

First, the global recession has taken its toll on economies abroad, and this wave of international buyers is smaller than previous ones. With foreigners no longer flocking to new developments and instead vying for sought-after resales along with local buyers, “it’s unrealistic to expect foreign buyers to absorb thousands of units of inventory,” said Jonathan Miller, the president of the appraisal firm Miller Samuel. He estimated that there is a “shadow inventory” of 6,000 unsold new development units in Manhattan, in addition to nearly 7,000 available listings.

During the boom, one of the most-repeated stories was the phenomenon of foreign buyers. As the dollar dropped in value against foreign currencies, buyers from all over the world — often middle-class families looking for a healthy return on their savings — flocked to Manhattan to buy shiny new condos, certain that the allure of the Big Apple would guarantee them lucrative investments.

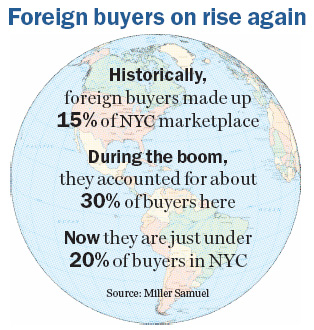

Historically, international buyers make up around 15 percent of the marketplace, Miller said. While the lore of foreign buyers was somewhat exaggerated at the time, he said, that figure rose to around 30 percent during the boom.

So great was the frenzy for Manhattan real estate that Sassoun recalls getting phone calls from overseas buyers asking to buy two or three new development condos at once.

“Most of them were smaller apartments,” she said. “A lot were bought with the intention of renting them out.”

After the market crashed in late 2008, however, foreign buyers backed out of the marketplace.

“When the market slowed down, we weren’t seeing anyone,” said Barbara Russo, the director of sales at condo conversion 40 East 66th Street, where some 80 percent of the buyers are international.

In the past several months, however, the flow of overseas buyers — especially those from Europe and South America — has started to pick up again, said Russo, who sold four apartments in the building over the holidays, all to international buyers as pied-à-terres. “They’re gaining confidence in the market and the euro is strong,” she said.

Miller estimated that the percentage of international buyers has now risen to just under 20 percent — less than during the boom, but more than the past year.

The number of international buyers is limited by many of the same problems confronting American buyers. Getting a mortgage, for example, is particularly difficult for foreigners.

During the boom, “there were a lot of lending channels for foreign buyers,” Miller said. Now, “the options for foreign nationals have dropped considerably.”

The difficulty of getting a mortgage is one reason why the foreign buyers currently in the market tend to be wealthier than in the past, brokers said. It’s no longer enough to cobble together a small down payment. In some cases, buyers now must be prepared to pay the full sale price in cash. And quick flips are no longer possible in a declining market.

The difficulty of getting a mortgage is one reason why the foreign buyers currently in the market tend to be wealthier than in the past, brokers said. It’s no longer enough to cobble together a small down payment. In some cases, buyers now must be prepared to pay the full sale price in cash. And quick flips are no longer possible in a declining market.

“You’re not dealing with the guy who has the 10 to 15 percent deposit,” said Rodrigo Nino, the president of the international real estate firm Prodigy Network. “You’re dealing with the guy who has the cash required to close.”

The few mortgage options that are available for international buyers require significant liquid assets. International buyers must put down at least 40 percent, said Julie Teitel, a senior vice president at Guardhill Financial Corp., up from 20 percent a few years ago. Even with a higher down payment, only three or four banks she works with will do mortgages for foreigners. One bank won’t do it unless the purchaser becomes a “premier client,” meaning they must keep at least $100,000 deposited in that bank. Another bank will not do a loan less than $500,000 for an international buyer.

“They’re really not looking to waste their time on smaller loans,” Teitel said.

Other international buyers are getting loans from foreign or domestic banks they have a private banking relationship with, said Nino, whose company recently instituted a dedicated closings team to help buyers find financing. High-net-worth individuals can often get low-interest loans from private banks by using their stock portfolios or property in other countries as collateral, he said, but that’s not an option for the average buyer.

“The smaller guys are out of the equation,” Nino said.

As a result of all these factors, “what we’re seeing now are more sophisticated buyers,” said Patricia Cliff, a senior vice president and director of European sales at Corcoran, who is currently working to find an apartment for an English venture capitalist. “They’re not the carpenters and plumbers from Ireland who were buying studios. They’re CEOs who have business commitments here.”

While many foreigners once sought new condos under $1 million, Sassoun said, the current batch of well-heeled buyers are seeking much more expensive apartments — though they’re looking for good deals in a wider variety of neighborhoods.

“It’s almost like there’s a better knowledge of the city,” she said, noting that some of her customers “would rather buy a unit Uptown than in one of the huge glass towers in the 40s.”

She said she frequently gets calls about high-end buildings like Manhattan House and the Time Warner Center. One building, 110 Central Park South, is popular with South Americans, she said.

Some are even “venturing into co-op territory,” she said, though only certain co-ops will consider foreign nationals.

That’s an attractive option, Cliff said, because some overseas buyers fear that new condos “could be risky investments.”

“They’re hesitant about ending up in one of these nightmares where the building doesn’t get finished,” she said.