Surfside unit owners reach tentative $83M settlement in collapse litigation

Surfside unit owners reach tentative $83M settlement in collapse litigation

Trending

Condo and homeowners associations in Miami-Dade required to disclose key financial, structural reports by 2023

Miami-Dade passes law to increase transparency among condo, homeowners associations

Miami-Dade County is attempting to increase transparency regarding condo and homeowners’ associations’ financial and structural health in the wake of last year’s deadly condo collapse in Surfside.

Such associations will be required to file structural reports, financial statements, insurance policies, budgets, and major planned projects to the county by February 1, 2023, and continue to do so on an annual basis.

The Miami-Dade County Commission approved the ordinance at its meeting on Tuesday.

Commissioner Rene Garcia sponsored the ordinance, and commissioners Jose “Pepe” Diaz, Danielle Cohen Higgins, Raquel Regalado and Rebeca Sosa co-sponsored it.

The county is expected to create an online searchable database that anyone can access. The new law will affect thousands of condo, co-op and homeowners associations countywide, many of which can be difficult to access information.

Currently, the sellers of condos, townhouses and homes within community associations can be the only source of information for prospective buyers. By law, sellers have to turn over financial documents and assessment reports to buyers only when a sales contract has been signed and the buyer requests the information, according to the Miami Association of Realtors, which praised the new legislation.

Read more

Surfside unit owners reach tentative $83M settlement in collapse litigation

Surfside unit owners reach tentative $83M settlement in collapse litigation

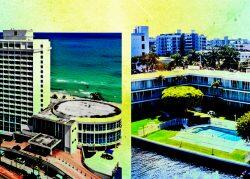

Up for sale: Older waterfront South Florida condo buildings look for bulk buyers

Up for sale: Older waterfront South Florida condo buildings look for bulk buyers

Miami-Dade County’s Department of Regulatory and Economic Resources will be tasked with enforcing the rule. Associations that don’t comply will be fined, according to the ordinance.

The law could help property owners, as well as buyers and their lenders. For buyers seeking Fannie Mae and Freddie Mac-backed mortgages, condo associations are now required to provide more information about the safety of condo buildings to lenders. The new rules went into effect in January and March of this year.

The Florida Legislature is also considering reforms regarding inspections and association reserves, all part of a response to the Surfside collapse.

Frank Simone, partner and general counsel at KW Property Management & Consulting, one of the largest property management firms in Florida, cited a tendency to overregulate following a major tragedy. But he said there “needed to be legislative changes in connection with Champlain Towers South.” The partial collapse of Champlain on June 24 killed 98 people.

The building had a number of structural issues and had just begun work tied to its 40-year recertification. Only Miami-Dade and Broward counties require buildings that are 40 years or older to go through the recertification process.

“If you’re going to buy a condo you want to know it’s structurally sound, well maintained and that its financial condition is in good shape, as well,” Simone said. “It benefits everyone.”

In December, a Miami-Dade grand jury empaneled to investigate the tragedy released its 43-page report, outlining recommendations for major changes, including accelerating the timeline for inspections and raising standards for those who perform them.