Trending

Saudis backed Colony Capital’s digital infrastructure deal, says report

The size of the investment by the kingdom’s Public Investment Fund has not been revealed

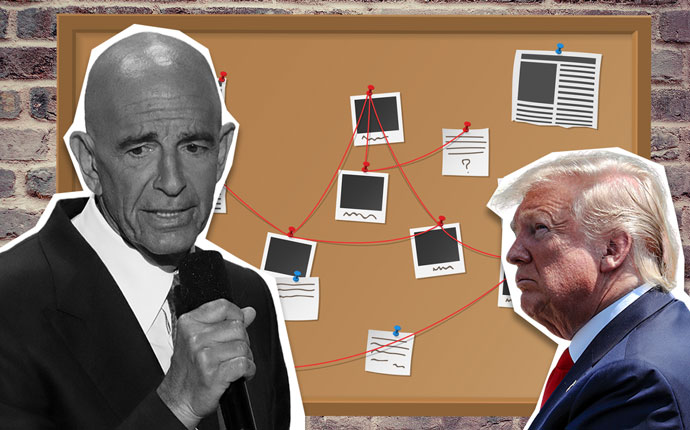

Colony Capital reportedly partnered up with a sovereign wealth fund from Saudi Arabia as it sought to invest in digital infrastructure after the 2016 presidential election.

The investment firm’s founder and CEO, Thomas Barrack, is a longtime friend and supporter of President Donald Trump, having served on his transition team, as well as an advocate of strengthening relations between the kingdom and the U.S.

Following the 2016 election, Bloomberg reports that Colony partnered with another firm, Boca Raton-based Digital Bridge Holdings, on a $4 billion digital infrastructure fund called Digital Colony Partners. Colony brought in the Public Investment Fund of Saudi Arabia (PIF), according to Bloomberg, which cited sources familiar with the matter.

The total investment from the Riyadh-based fund, which comes amid increased scrutiny of the kingdom’s human rights record, has not been revealed. Bloomberg, citing one person familiar with the deal, reported that the Saudis ultimately invested nine figures. An adviser to Barrack declined the outlet’s request for comment about the nature of Colony’s partnership with the PIF.

Last week, Colony announced a $325 million deal to acquire Digital Bridge, a digital infrastructure investment firm. Colony is now reportedly in talks with the PIF about partnering up on the purchase of a minority stake in Burbank, California-based film and television studio Legendary Entertainment.

The Real Deal reported last week that Barrack will step down as CEO in 2021 as a result of Colony’s acquisition of Digital Bridge, whose chairman, Marc Ganzi, will succeed him.

In November, Barrack ousted former Colony CEO Richard Saltzman as the Los Angeles-based firm’s stock price fell following its merger with NorthStar Asset Management.

[Bloomberg] — Sylvia Varnham O’Regan