Trending

Sale of Underground Railroad site to city caps off “financial disaster”

Despite $3.2M price, seller’s attorney says aborted project cost him a bundle

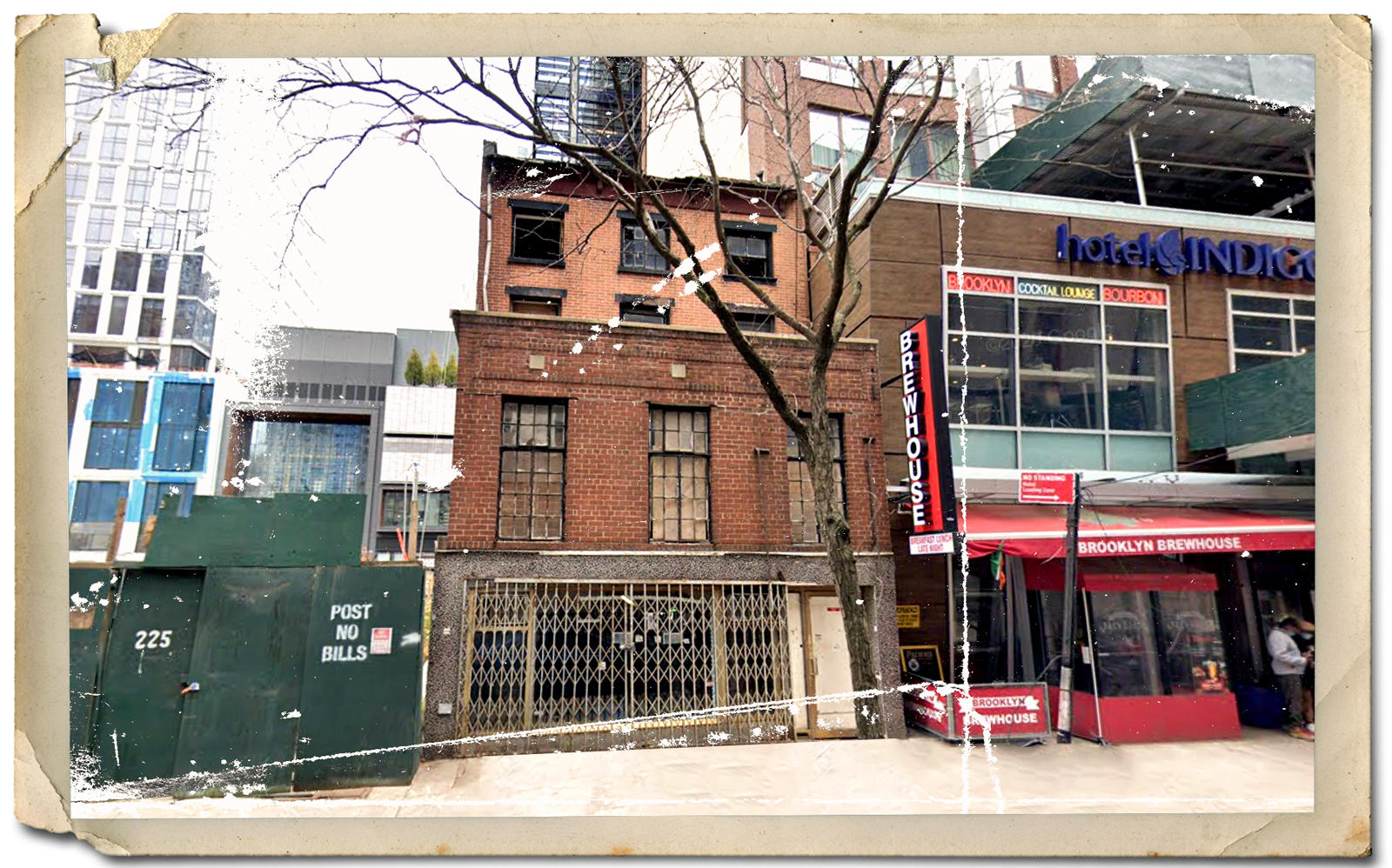

The de Blasio administration has purchased an abolitionist’s home in Downtown Brooklyn that recently received landmark status — ending a controversial developer’s plans for the site.

On Monday, Mayor Bill de Blasio’s wife Chirlane McCray announced the city purchased 227 Duffield Street for $3.2 million. The circa-1850 building is believed to have ties to the Underground Railroad, and while plans for the site are unclear, McCray stated that the purchase ensures the property “will be protected and celebrated for a very long time to come.”

The acquisition came just a month after the Landmarks Preservation Commission gave the building historic status — which years ago it had refused to do.

The designation made the property impossible to develop, according to an attorney for the site’s previous owner, Brooklyn developer Samiel Hanasab.

The lawyer, Garfield Heslop, said the project’s landmark status prevented Hanasab from moving forward plans to demolish the property and build a 13-story mixed-use development — hence the sale to the city. In total, Heslop claims that Hanasab lost over $3 million.

“It was a financial disaster,” Heslop said.

How 227 Duffield Street came to be owned by Hanasab is not a simple story. For decades it was reportedly owned by the family of Joy Chatel, a community activist known as Mama Joy. In 2004 she signed the deed over to her mother, Arnelda Monroe, who sold half of her ownership to investor Errol Bartholomew a year later.

In 2015 Hanasab paid $439,000 for Bartholomew’s stake. In 2017, the developer acquired the remaining 50 percent from Monroe for $149,000, according to property records.

The total, $588,000, may sound like a steal for Downtown Brooklyn real estate with development potential.

But Hanasab’s lawyer Garfield Heslop says that when Hanasab purchased the property, he also assumed a delinquent mortgage with a pending foreclosure lawsuit. (A foreclosure suit tied to the 2004 mortgage was filed in state court in 2015 and discontinued in 2018, according to court records.)

Hanasab took out a $1.59 million mortgage in 2017 and a $715,000 mortgage two years later, property records show. Heslop said the loans were used to pay down the previous mortgage, which was in foreclosure.

In 2019 Hanasab filed a demolition permit with the city, but a year later he was facing foreclosure; a lender claimed Hanasab had been delinquent on the two mortgages since February 2020. The suit was discontinued this month.

Hanasab and Yuval Golan, another former investor in 227 Duffield Street, have faced scrutiny for how they have acquired some properties.

The guardian of an elderly (now deceased) owner of a Brooklyn home sued Hanasab and Golan in 2010, alleging they defrauded the investors and withheld funds from the sale of her house. A judge ordered Golan and Hanasab to pay the petitioner over $200,000 in unpaid compensation but dismissed the fraud allegations.