ICSC’s “incredibly tragic day” and rough year ahead

ICSC’s “incredibly tragic day” and rough year ahead

Trending

Diminished return: What’s next for ICSC?

Vegas event sparks discussions on the state of retail, raises questions about organization’s future

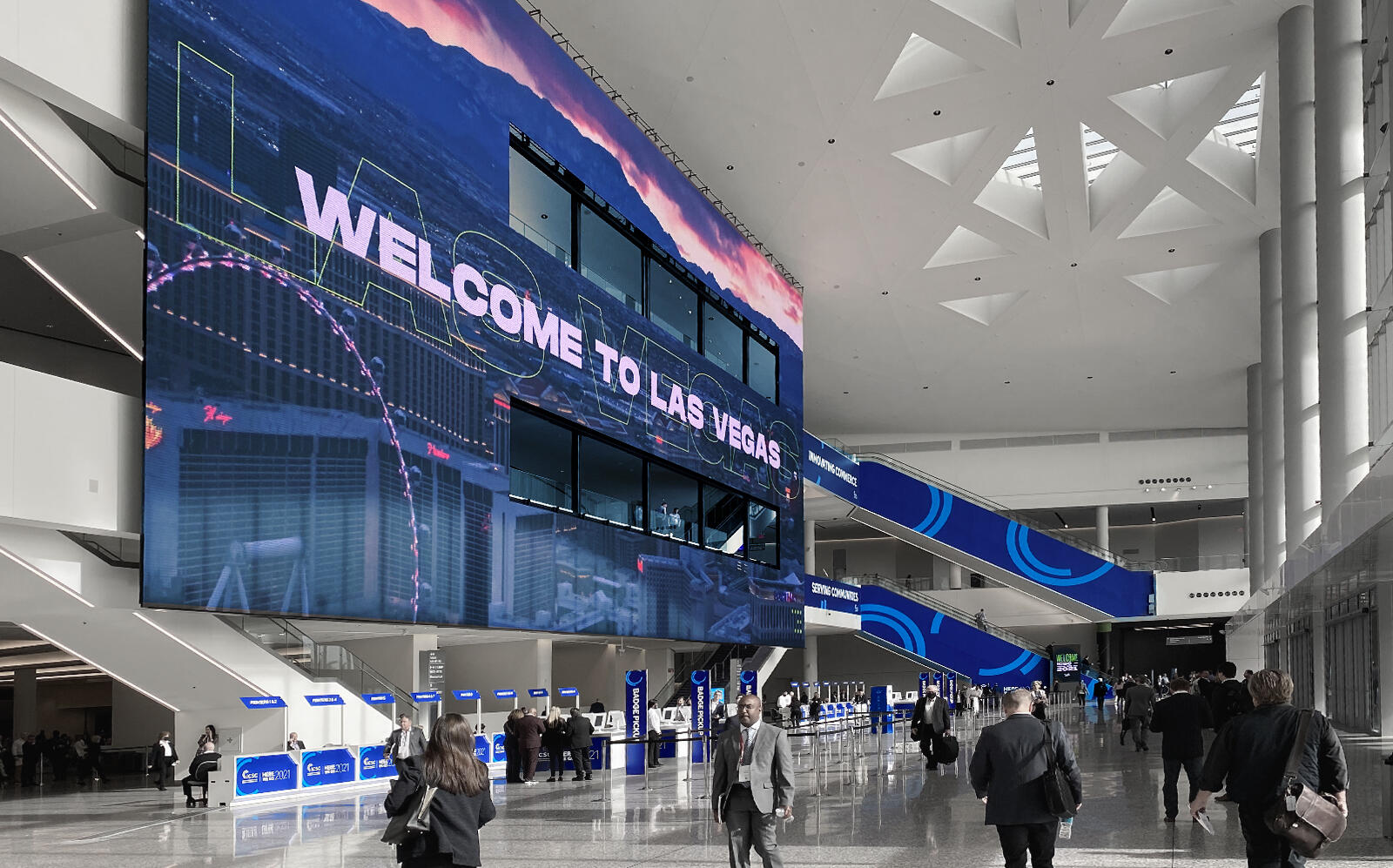

After a nearly two-year Covid hiatus, ICSC’s return to Las Vegas last week attracted a tepid response from the industry, leading some to wonder whether it was merely a temporary symptom of the pandemic or representative of the new normal.

If the latter, the trade organization could be in for some trouble. Most of its revenue has historically come from its in-person conferences. The Las Vegas event, in particular, was seen as a must-attend for retail landlords, retailers and brokers to strike up business from across the country. Some 30,000 dealmakers schmoozed during the day and indulged in blackjack and liquor at night.

This year, fewer than 10,000 showed up. By the event’s second day, the halls were nearly empty. Around noon, skeletal crews had begun dismantling exhibit booths.

It is unclear exactly how much money ICSC made — or lost — from the December event. But past financials showed thin margins. In 2019, ICSC’s revenue totaled $75.5 million, with $71 million coming from “program services,” according to the nonprofit’s financial documents. Its expenses, meanwhile, totaled $69.9 million, leaving net income of $5.6 million. An ICSC representative did not respond to a request to comment on its financials this year, which are not publicly available.

(ph: Sasha Jones)

Not only was attendance down, some exhibitors were not paying for their booths. Many who spoke to The Real Deal said they were awarded a credit after last year’s event was postponed. Memberships were also repeatedly extended for free during the pandemic.

While some cited Covid concerns as a reason for the weaker attendance, large-scale events like ICSC face an existential threat in a post-pandemic world. Are massive trade shows still relevant, or will Zoom suffice?

Given that ICSC is returning to Vegas with a three-day conference in May, some questioned whether the December event was merely a cash grab after nearly two years of lost income. As the pandemic hit, the organization laid off a majority of its employees, including 18 of its 22 event staffers. Even prior to the pandemic, ICSC had struggled with declining membership and longstanding internal strife, according to interviews last year with more than a dozen former staffers and current members.

It’s unclear how Covid impacted ICSC’s total assets or whether the group had to take on more debt. But its financials show the organization was on solid footing before the pandemic, with $163 million in assets against $50.5 million in debts in 2019, according to its financial data — seemingly more than enough to weather a storm.

“There’s an existential question in all this, which is, what was the real reason this thing happened?” said Nick Egelanian, president of the consulting firm SiteWorks and an adjunct professor at the University of Maryland.

Nonetheless, some attendees preferred the smaller setting.

“At RECon, because it’s so big, you spend 90 percent of your time running from one place to another or hidden in a conference room in our booth in the back corner for six hours in a row,” said Brian Katz, CEO of Katz and Associates.

Jordan Gorjian of Gorjian Acquisitions (photo: Keith Larsen)

Jordan Gorjian, director of leasing at Long Island-based Gorjian Acquisitions, said his group became extremely active on LinkedIn during the lockdown last year, and made a number of connections to retailers. The event was an opportunity to meet those people in person for the first time in two years.

“It’s been great to kind of see them and meet them face to face, and just really talk to them in person,” said Gorjian. “It’s really been a game changer.”

It was difficult to gauge the state of the retail market by talking to attendees, all of whom had a stake in the industry. As such, nearly everyone TRD spoke with said demand for retail space was surging.

New York retail brokers and landlords, however, did provide some nuance on emerging trends.

James Famularo, president of retail leasing at Meridian Capital Group, said he is getting more calls about micro-fulfillment centers for rapid-delivery startups such as Gorillas and Fridge No More, which offer grocery deliveries in as little as eight minutes and are taking over traditional retail sites.

“Everybody complains about Amazon killing retail, but they are renting more retail spaces than everyone else and so are all these apps,” said Famularo.

Famularo added that he is also seeing a number of deals for second-generation restaurants, and he is working on a deal to bring an NFT gallery to a physical location that has a “matching virtual gallery in the metaverse.”

Others noted seeing similar deals, as well as interest from medical and dental offices in taking over traditional retail space.

The age of Zoom also presents a hurdle for events like ICSC as dealmakers have grown comfortable meeting “face-to-face” remotely. But for some, virtual meetings can’t match in-person interaction.

“Sitting with someone, having a drink and spending time with them in person. There is absolutely nothing like it,” Morris Sabbagh, co-founder of Kassin Sabbagh Realty. “It is irreplaceable.”

Read more

ICSC’s “incredibly tragic day” and rough year ahead

ICSC’s “incredibly tragic day” and rough year ahead

Industry players kick off ICSC 2019 with gossip, dealmaking at the Wynn pool: PHOTOS

Industry players kick off ICSC 2019 with gossip, dealmaking at the Wynn pool: PHOTOS