Vanbarton Group, church sued by foreign investors in fallout from HFZ debacle

Vanbarton Group, church sued by foreign investors in fallout from HFZ debacle

Trending

Church seeks to escape hellish partnership with HFZ

Marble Collegiate and lenders reach deal over botched NoMad development

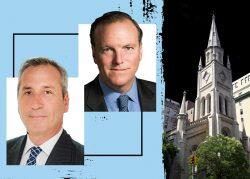

Marble Collegiate Church thrived for nearly 400 years. Then it made a deal with HFZ Capital Group.

The church partnered with the beleaguered New York City developer in 2013 to build a tower next to the church, in NoMad on the corner of West 29th Street. By late 2020, HFZ had defaulted on $205 million in loans and was engulfed in foreclosures and lawsuits. A year later, Vanbarton Group, the mezzanine lender, foreclosed on the development site.

But the church’s problems didn’t end there. Vanbarton, citing guarantees on the loans, went after the joint venture for $68.7 million. Marble Collegiate said its former partner, HFZ, can’t pay because of its financial problems.

The church is now asking a state judge to approve a settlement to prevent the further losses to the house of worship and its real estate arm, Collegiate Asset Management.

“These liabilities, even at the level of $68.7 million, would have devastating consequences for CAM and the church’s ability to carry out its mission,” the church said in a petition seeking approval of the settlement.

As part of the deal, Vanbarton and another lender, Otera Capital, would release Marble Collegiate from its guarantees. In exchange, the church would hand over air rights and a neighboring development site valued at close to $80 million.

The church is known for its longtime pastor Norman Vincent Peale, who wrote “The Power of Positive Thinking.” But its lawyers say more than optimism would be needed if the settlement doesn’t go though. That is, it would likely have to sell other properties to satisfy the lenders.

The church’s petition, filed in New York Supreme Court, provides a rare behind-the-scenes look into one of the largest casualties of HFZ’s collapse.

Marble Collegiate was no stranger to development deals. For more than two decades its real estate arm was spearheaded by Casey Kemper, a former executive at now-defunct development firm Olympia & York, and amassed a formidable portfolio throughout the city.

Among the properties it purchased were several on a block bordered by West 29th and West 30th streets and Fifth and Sixth avenues, setting the stage for a lucrative development: The area was coveted by tech firms seeking office space and by high-income employees shopping for a place to live.

The church went looking for a development partner. By January 2013 it had received bids from Starwood, the Lam Group, Archstone, Albanese, JD Carlisle, all established firms. But it was won over by HFZ, the upstart luxury condo developer led by Ziel Feldman and Nir Meir.

The two sides hammered out a deal. The church would contribute its properties and receive $27 million in cash, a 50 percent equity interest in the venture and a promise that a $58.5 million community facility would be built as part of the project, according to the petition.

Read more

Vanbarton Group, church sued by foreign investors in fallout from HFZ debacle

Vanbarton Group, church sued by foreign investors in fallout from HFZ debacle

HFZ, Marble Collegiate Church lose NoMad development site

HFZ, Marble Collegiate Church lose NoMad development site

Faith alone: How one Manhattan congregation got caught in HFZ’s downfall

Faith alone: How one Manhattan congregation got caught in HFZ’s downfall

The plan was initially for a 64-story residential tower but later shifted to a 34-story, 600,000-square-foot office building designed by architect Bjarke Ingels. The church estimated it would enjoy 10 percent annual returns.

By 2018, the joint venture had secured bridge financing to start excavation. It got a $148 million loan from Otera and a $91 million mezzanine loan from Vanbarton. HFZ and CAM included full-recourse guarantees, making the firms liable for the full amount of the loans if certain events occurred. Feldman was also personally liable for the guarantees.

The next year, with nothing yet built at the site, the joint venture secured a $60.6 million loan from EB-5 investors. But the clock was ticking on the bridge loans, and after short-term extensions, they matured in October 2020. Late in the year, Vanbarton moved to seize the property.

The foreclosure sale took place in April. Vanbarton, the only bidder, purchased the equity interests in the property with a credit bid of $85 million. But it wasn’t done with the developer and the church.

Months later, Vanbarton claimed HFZ and CAM owed the $68.7 million because of the guarantees. Vanbarton also demanded $14.3 million for completed project work. The lender could assert additional liabilities because $126 million in bridge loans remained outstanding, according to the petition.

The church’s only option was to claw back some of its properties and rights. Marble Collegiate said the sale of one lot and air rights could be invalid because the church failed to receive court approval needed by religious organizations. Vanbarton denied the approval was necessary.

Eventually, though, the parties came to terms. Vanbarton agreed to pay Marble Collegiate $6.5 million for repairs to one of its church buildings and $1.5 million in cash. Vanbarton and Otera agreed not to sue HFZ over the NoMad project.

HFZ, Vanbarton, Marble Collegiate and the church’s lawyer did not return a request for comment. Otera Capital declined to comment.