Office landlords profess optimism despite dip in occupancy

Office landlords profess optimism despite dip in occupancy

Trending

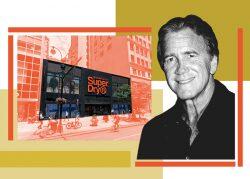

Jeff Sutton buys Weehawken office for $219M

Retail billionaire partners with KTB Securities

Jeff Sutton is switching things up.

The retail real estate mogul has partnered with institutional Korean investment firm KTB Securities to buy a Weehawken, New Jersey, office complex for $219 million. Yes, office.

Sutton and KTB bought 1000 Harbor Boulevard from Hartz Mountain Industries, financed by a $131.4 million loan from Korean lender KB Kookmin Bank. PincusCo first reported the sale, which closed about a week ago.

The 617,187-square foot complex, also known as Lincoln Harbor, is leased to the global bank UBS. That lease runs into 2035. The building was built in 1989.

Read more

Office landlords profess optimism despite dip in occupancy

Office landlords profess optimism despite dip in occupancy

Jeff Sutton will replace Midtown retail space with hotel

Jeff Sutton will replace Midtown retail space with hotel

Sutton declined to comment.

This isn’t the first time Sutton, KTB and KB Kookmin have paired up. The fund acquired a majority in the Williamsburg, Brooklyn, retail property 103 North 4th Street for $31.3 million in March 2021, with $20.1 million financed by the bank.

However, the New Jersey purchase is noteworthy as it indicates a new area of investment for Sutton. The billionaire has made his fortune largely by investing in retail properties.

Still, Sutton has ventured into other sectors of real estate. In 2016, his son Joseph, with backing from his father, invested in residential real estate. Earlier this year, Sutton’s Wharton Properties filed plans to develop a hotel on West 34th Street.

It’s not uncommon for Sutton to make non-retail purchases through partnerships. The Brooklyn billionaire has worked with office REIT SL Green Realty and developer General Growth Properties, among others.

Jeff Dunne of CBRE and Andy Merin of Cushman and Wakefield represented Hartz in the Weehawken deal. Both declined to comment.

As employees continue to work from home, offices have sat empty, leading to an decrease in occupancy and an increase in subleasing. Sutton’s buy may be a bet that the office market — especially in lower-scale areas outside New York City — is underpriced and will recover.

[PincusCo] — Sasha Jones