Trending

Bank of Southern California puts Neil Shekhter portfolio up for sale

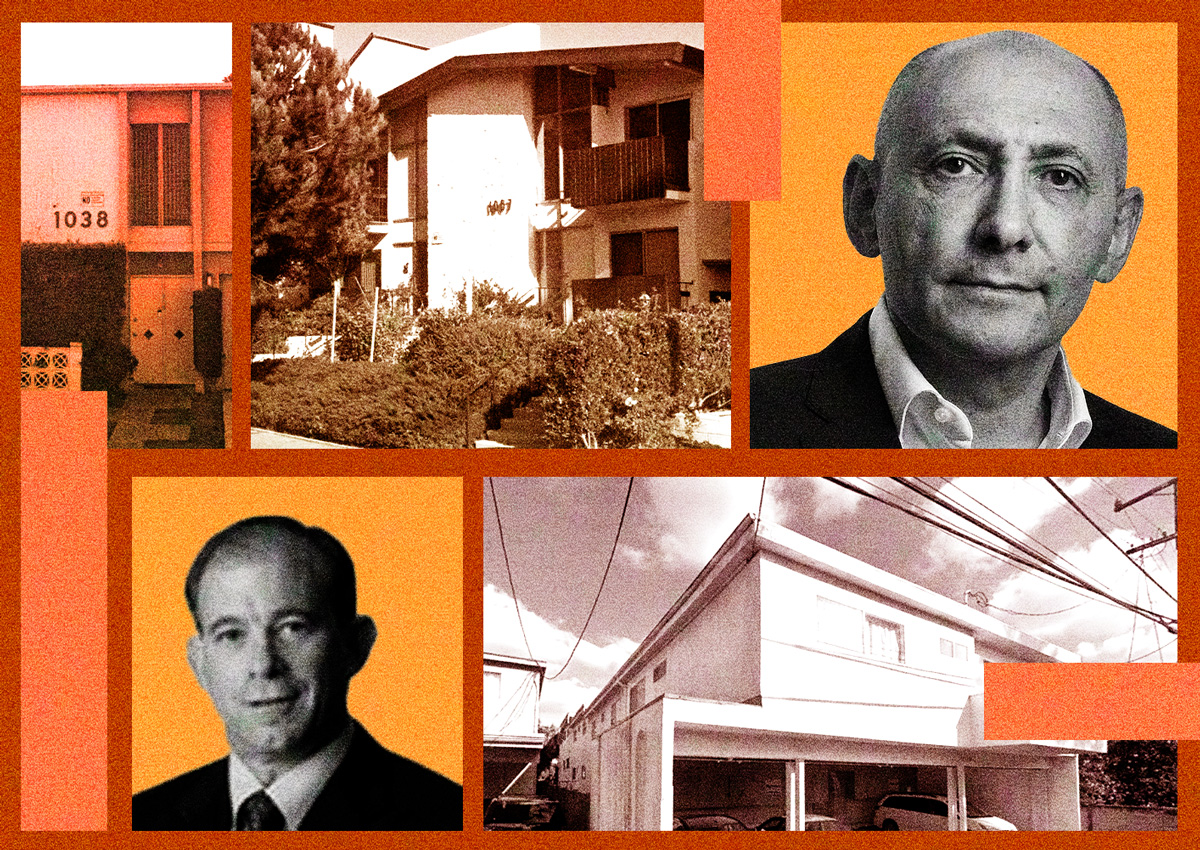

Once one of LA's largest landlords, now three of his distressed Santa Monica properties are listed

Bank of Southern California has listed three apartment complexes in Santa Monica for sale — properties formerly owned by developer Neil Shekhter, The Real Deal has learned.

The bank foreclosed on the three buildings at 1038 10th Street, 1007 Lincoln Boulevard and 1516 Stanford Street in February, L.A. County records show, after Shekhter defaulted on almost $16 million in loans tied to the properties.

At a public auction, Bank of Southern California foreclosed with a credit bid of $9.5 million, coming out to about $394,000 per unit.

Now the bank is asking $10.8 million for the three buildings, which together total 24 units, according to listings on LoopNet for the property. At that price point of $450,000 per unit, Bank of Southern California could recoup some of its loss that came from Shekhter’s unpaid debt. A team led by JLL’s Luc Whitlock is marketing the portfolio for sale.

Shekhter paid about $10.6 million for the three buildings between 2015 and 2016, property records show.

The buildings can be bought individually or as one portfolio, according to the LoopNet listing. Almost half of the units will be vacant at the time of sale.

The properties could be bought by owner-occupiers — someone who could occupy one of the units and rent out the rest, according to JLL’s marketing materials.

Shekhter and his firm, WS Communities, had refinanced the three properties in September 2022, using a business loan from Bank of Southern California, court records show.

Shekhter’s sons Adam, Alexander and Alan Shekhter, each signed unlimited personal guarantees with recourse, meaning if the properties could not pay back the loan, the brothers would be personally liable for paying it back, according to court documents.

Bank of Southern California had sued Shekhter’s sons over the defaulted loans, claiming the three “failed and refused, and continue to fail and refuse, to pay the sums due and owing to plaintiff, in breach of said guaranty,” court records show.