Ugo Colombo plans Four Seasons in Coconut Grove: sources

Ugo Colombo plans Four Seasons in Coconut Grove: sources

Trending

Fort Partners lands $410M refi for Four Seasons in Surfside, Palm Beach

Four-year, interest only loan carries 8.7% interest

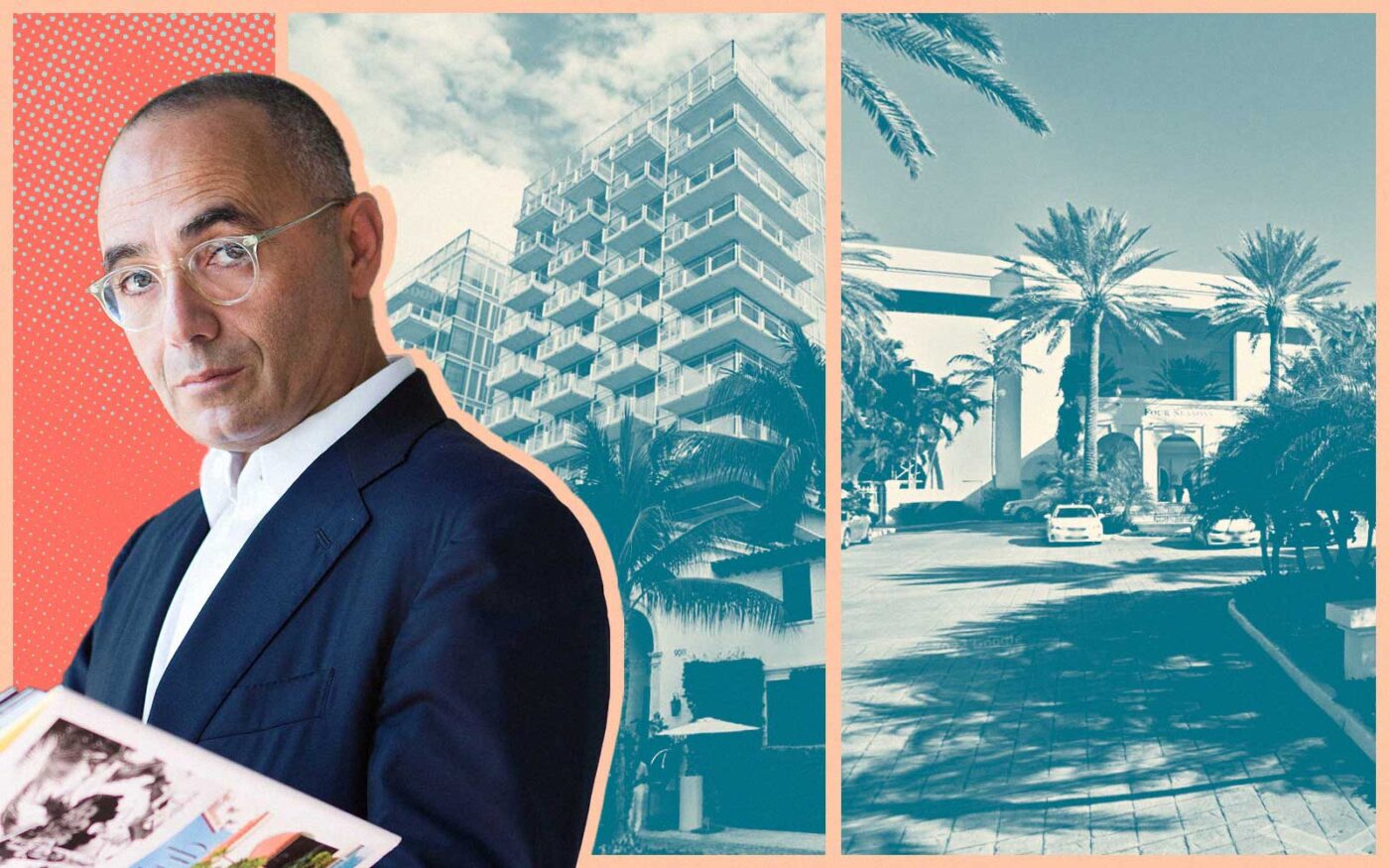

Nadim Ashi’s Fort Partners is scoring a $410 million refinancing of two Four Seasons properties in South Florida.

The commercial mortgage-backed securities loan will refinance the Four Seasons Resort at the Surf Club in Surfside and the Four Seasons Resort Palm Beach, according to the credit rating agency DBRS Morningstar. Citi Real Estate Funding and German American Capital Corp. are the loan originators. The four-year interest only loan is at a fixed rate of 8.7 percent.

The two luxury hotels, at 2300 South Ocean Boulevard in Palm Beach and at 9011 Collins Avenue in Surfside, total 309 rooms. Fort Partners owns all of the Four Seasons properties in South Florida, including in Fort Lauderdale and on Brickell Avenue in Miami.

Morningstar values the hotels at $450.3 million, though the lender’s appraisal firm gave the hotels a much higher valuation of nearly $800 million, according to Morningstar’s report. The loan-to-value based on the $800 million valuation is just over 50 percent. Eastdil Secured arranged the financing.

It is unclear if the loan has closed yet. Morningstar’s report was issued on Tuesday, and no new financings have been recorded. Fort Partners did not immediately respond to a request for comment.

The refinancing will pay off a $310 million loan provided in 2021 and includes about $56.5 million in cash for the developer, according to Morningstar.

Fort Partners developed the Four Seasons Hotel and Residences at the Surf Club on a 2.3-acre oceanfront site in Surfside in 2017. The oceanfront resort includes two luxury condo buildings. The hotel also benefits from residential rental income from 25 units in the developer’s revenue sharing agreement, according to Morningstar. Even though occupancy experienced an annual decline in 2022, the average daily rates for the condos rose 63 percent percent in 2022 to more than $6,000.

Fort Partners bought the nearly 8-acre Palm Beach resort in 2014 for an undisclosed amount. The developer completed a $74 million renovation in 2019. More recently, Fort Partners invested more than $6 million into upgrading the ballrooms and meeting spaces, according to the report.

The two hotels are among the most expensive in South Florida.

In Palm Beach, the 207-key Four Seasons beat its competitors on average daily rate and revenue per available room but not occupancy, which are a standard set of metrics the hotel industry relies on. Four Seasons reported an ADR of more than $1,300 per night in 2022, $750 revPAR and 85 percent occupancy, according to Morningstar, which used data from STR. Its top competitors are the Breakers Palm Beach Hotel and Eau Palm Beach Resort & Spa.

In Miami-Dade County, the 102-key Four Seasons’ ADR and revPAR were far higher than other hotels at nearly $2,800 per night and $1,700, respectively. Occupancy was about 95 percent in 2022, according to estimates included in the Morningstar report. Competitors include the St. Regis Bal Harbour Resort, Acqualina Resort & Residences in Sunny Isles Beach and the Setai South Beach.

The hotels are not immune to rising insurance premiums. Insurance costs for the properties have increased more than 225 percent since 2019, according to the Morningstar report.

Last year, Fort Partners paid off its $210 million construction loan for the Four Seasons Residences Fort Lauderdale, which at the time was the largest such loan recorded in the city’s history. New York-based Madison Realty Capital provided the financing in late 2019.

Read more

Ugo Colombo plans Four Seasons in Coconut Grove: sources

Ugo Colombo plans Four Seasons in Coconut Grove: sources

Craig Robins, Fort Partners and Qatari hotel firm buy Apollo site in Miami Design District

Craig Robins, Fort Partners and Qatari hotel firm buy Apollo site in Miami Design District

Fort Partners pays $42M for Surfside condo development site

Fort Partners pays $42M for Surfside condo development site