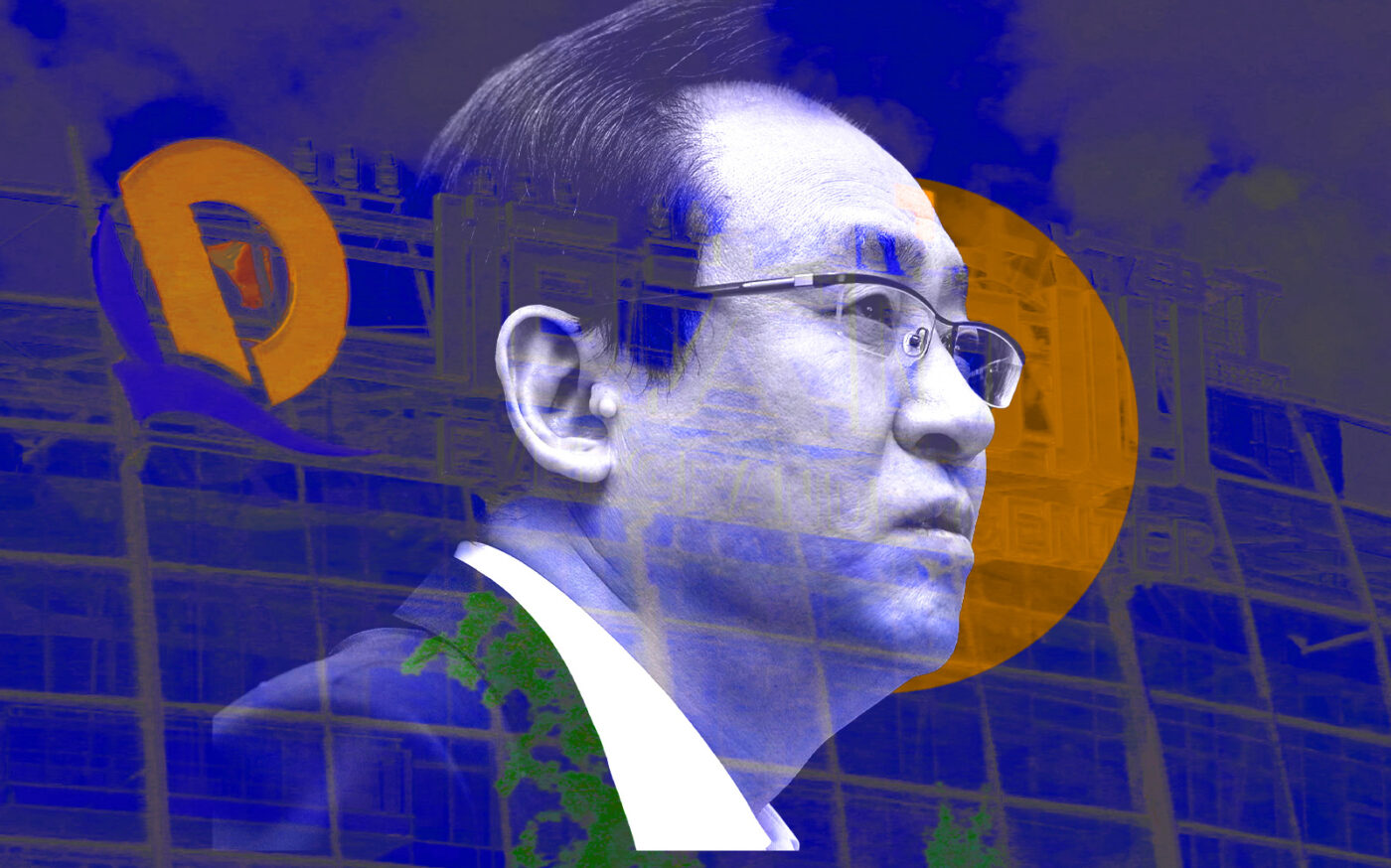

Chinese developers in US struggle as Evergrande mess threatens business back home

Trending

Evergrande eyes debt restructure deal after default disaster

World’s most indebted developer is nearing a deal with foreign bond investors

Evergrande, the Chinese firm that became known in 2021 as the world’s most indebted developer, is nearing a debt restructuring deal.

The developer has agreed on a deal with foreign bond investors that will extend its debt maturities and defer coupon payments, people with knowledge of the deal told the Wall Street Journal. The landmark arrangement could serve as an example for deals to come across China’s troubled development sector.

News of a deal comes as the Shenzhen-based firm is due back in court on March 20 for ongoing hearings on its negotiations with bondholders, which was the subject of a November hearing. The investors in negotiations with the firm are largely distressed debt funds who bought the bonds after the company’s Dec. 2021 default.

Investors will take an unspecified cut on some of the bonds as the firm will substitute newly issued bonds for their current holdings, including those backed by its property management and electric vehicle businesses.

Chairman and founder Hui Ka Yan will also convert loans he made to Evergrande’s electric vehicle arm into shares in the company.

Before news surfaced of its default and cut from Fitch Ratings, the company first reported more than $300 billion in liabilities in June 2021.

Evergrande said at the time of its default it would “actively engage” with offshore creditors for a restructuring plan. Major investment firms, including Blackrock and Allianz, were among those waiting repayment as a reported $7.4 billion of onshore and offshore bonds were forecast to come due in 2022.

The firm’s troubles spelled concerns for developers overseas and global markets. Some of China’s most active developers in the U.S. were flagged as risks ahead of its default, including Oceanwide Holdings, China Vanke and Greenland.

Evergrande is closely followed by embattled Chinese developer Kaisa, the second most indebted firm and one of the sector’s early defaults after failing to make a repayment on a $400 million bond. Bloomberg previously reported the two developers comprise nearly 15 percent of the outstanding dollar bonds from Chinese developers.

— Ellen Cranley