Chinese developer Evergrande to liquidate

Chinese developer Evergrande to liquidate

Trending

Chinese developer accused of historic $78B fraud

Collapsed real estate giant was ordered to liquidate in January

As Chinese developer Evergrande faces liquidation, China’s top securities regulator is accusing the company and its founder of a historic financial fraud.

In the two years leading up to Evergrande’s default, the company’s onshore unit inflated its revenue by $78 billion, according to an accusation from the China Securities Regulatory Commission reported by Bloomberg. The securities regulator also fined the onshore unit $581 million.

The inflated revenue amounts to half of Hengda Real Estate Group’s revenue in 2019 and 79 percent of that in 2020, according to the CSRC. Hengda allegedly used its inflated figures in marketing to issue bonds.

Evergrande previously recognized revenue from apartments that were presold, but not yet delivered. In 2021, it updated its approach to count revenue only after units were delivered or occupied.

The large fine spells more trouble for Evergrande’s antsy creditors. The company counts roughly $332 billion in liabilities, which it was going to start addressing after a January order to liquidate by a Hong Kong court.

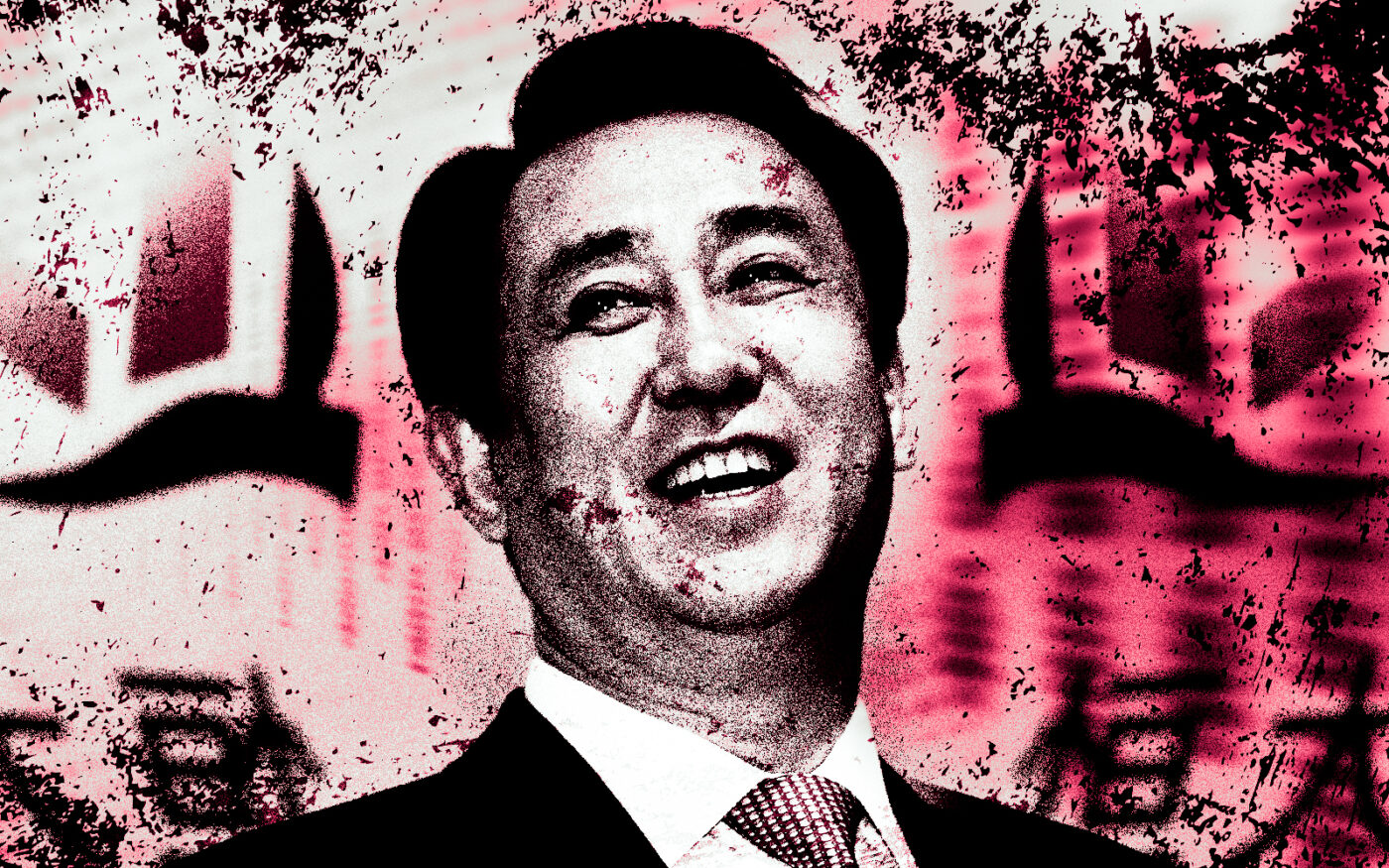

The CSRC’s action also further imperils Hui Ka Yan, Evergrande’s beleaguered founder. He was briefly detained by police last year over “suspicion of illegal crimes,” though he never faced criminal charges. His whereabouts are unknown.

Hui was personally fined $6.5 million and banned from China’s financial markets for life, according to the New York Times.

Read more

Chinese developer Evergrande to liquidate

Chinese developer Evergrande to liquidate

Evergrande files for bankruptcy in the US

Evergrande files for bankruptcy in the US

Evergrande amassed $81B in losses in two years

Evergrande amassed $81B in losses in two years

At one point, Evergrande was the world’s most indebted developer. Its portfolio spans across hundreds of cities in China and its business goes beyond real estate.

The company filed for Chapter 15 bankruptcy protection in the United States last summer as it sought to restructure. Evergrande defaulted on an offshore dollar bond in December 2021, sending its fortunes plummeting. Between 2021 and 2022, the company lost $81 billion.

An attempt to negotiate with overseas investors over the summer was thwarted when Hui was detained and several company executives were arrested. It’s unclear how much value creditors will be able to wring out of Evergrande’s assets.