Mall owner PREIT on verge of another bankruptcy, with over $1B debt

Mall owner PREIT on verge of another bankruptcy, with over $1B debt

Trending

Philadelphia’s PREIT emerges from bankruptcy, once again

Shopping mall owner has new leaders, $800M less in debt

Officials of the Pennsylvania Real Estate Investment Trust are hoping that the second time through bankruptcy is a charm.

The Philadelphia-based shopping center owner has emerged from bankruptcy once again, the Philadelphia Inquirer reported. The real estate investment trust is now controlled by the investment firms that bought PREIT’s debt. Redwood Capital Management and Nut Tree Capital Management combined to provide $130 million in financing to PREIT.

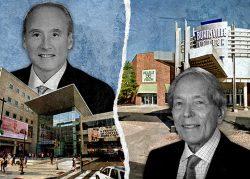

Glenn Rufrano, formerly head of Cushman & Wakefield and recent chair of the International Council of Shopping Centers, takes over as executive chair of PREIT. One-time Brookfield Properties CEO Jared Chupaila is taking on the same role with the shopping center operator.

Former CEO Joseph Coradino exits after a dozen years leading the company, though he’ll stay on as a consultant for six months. His severance payment is expected to top $4 million.

The REIT ponied up $10 million to get rid of former outside shareholders. Through its reorganization, PREIT reduced its debt load by $800 million, though it’s still saddled by more than $1 billion in debt.

As for its holdings, the company notably walked away from the Fashion District Philadelphia shopping center, which is being left to Macerich, PREIT’s partner at the property. PREIT still has 13 malls in the Mid-Atlantic, primarily around Philadelphia and Washington, D.C.

Rufrano suggested some of the baker’s dozen of assets remaining could see a reduction in retail use and an increase in other forms of real estate, such as residential use or hotels.

While more than 80 percent of PREIT’s stores stopped paying rent during the height of the pandemic, payments are more consistent today, according to Rufrano. The portfolio has an occupancy rate of over 90 percent and the company doesn’t plan any mass asset sales at the moment.

The New York Stock Exchange delisted PREIT in December 2022 after a 99 percent price drop during the pandemic, kicking the company off the ticker for the first time in more than 60 years.

Read more

Mall owner PREIT on verge of another bankruptcy, with over $1B debt

Mall owner PREIT on verge of another bankruptcy, with over $1B debt

Struggling mall owner booted from New York Stock Exchange

Struggling mall owner booted from New York Stock Exchange

Mall owners CBL Properties and PREIT file for bankruptcy

Mall owners CBL Properties and PREIT file for bankruptcy