Trending

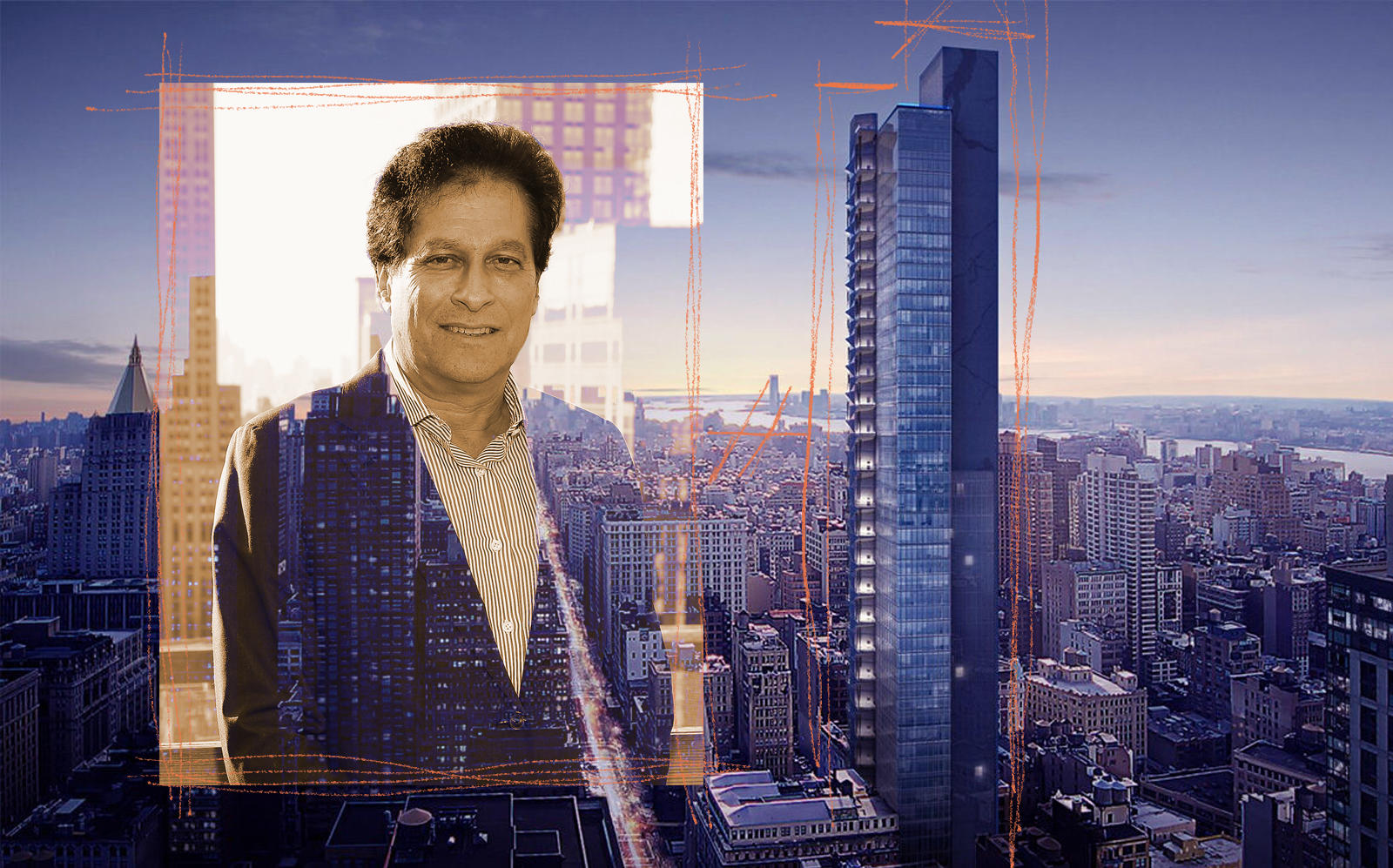

Lender schedules foreclosure auction at HFZ’s Nomad site

Ziel Feldman's firm is facing trouble across its portfolio

HFZ Capital Group is in danger of losing another project in its embattled development portfolio.

Ziel Feldman’s firm is facing foreclosure on the mezzanine position at a NoMad development site where it plans to build a 600,000-square-foot office tower, according to a notice scheduling the UCC auction reviewed by The Real Deal.

The mezzanine lender on the site, the Vanbarton Group, has scheduled a UCC foreclosure auction for late March.

Representatives for HFZ and Vanbarton Group did not immediately respond to requests for comment. Eastdil Secured, which is handling marketing for the auction, did not immediately respond to a request for comment.

Vanbarton made a $90.9 million mezzanine loan to HFZ for the property, according to the auction’s offering memo.

HFZ’s site consists of eight parcels on the block between Fifth Avenue and Broadway between 29th and 30th Street, with another under contract. With additional air rights and a bonus for a public plaza, the assemblage has a total of 617,167 square feet of development rights.

HFZ enlisted architect Bjarke Ingels to design a modern office skyscraper for the site, but the company is facing significant financial troubles as it tries to hold on to other properties.

Earlier this month, the company got a last-minute reprieve when a Manhattan judge called off a similar UCC foreclosure auction on HFZ’s stake in a portfolio of four prewar apartment buildings it is converting into residential condominiums. The mezzanine lender there, CIM Group, still has the option of scheduling a new auction, provided it meets certain conditions.

Also in December, HFZ lost its stake in a 12 million-square-foot portfolio of national warehouse properties to foreclosure.

And the company’s marquee project, the XI development on the High Line in West Chelsea, has dealt with slow sales, a construction stoppage and a mob scandal. Neither Feldman nor HFZ’s former managing principal, Nir Meir, were indicted in the scandal.

Meir recently left the firm, and Feldman took over day-to-day responsibilities.