Silverstein buys majority stake in Taconic’s 619 West 54th

Silverstein buys majority stake in Taconic’s 619 West 54th

Trending

Silverstein selling stake in life sciences hub

Majority stake of Hudson Research Center up for grabs, with Taconic as minority partner

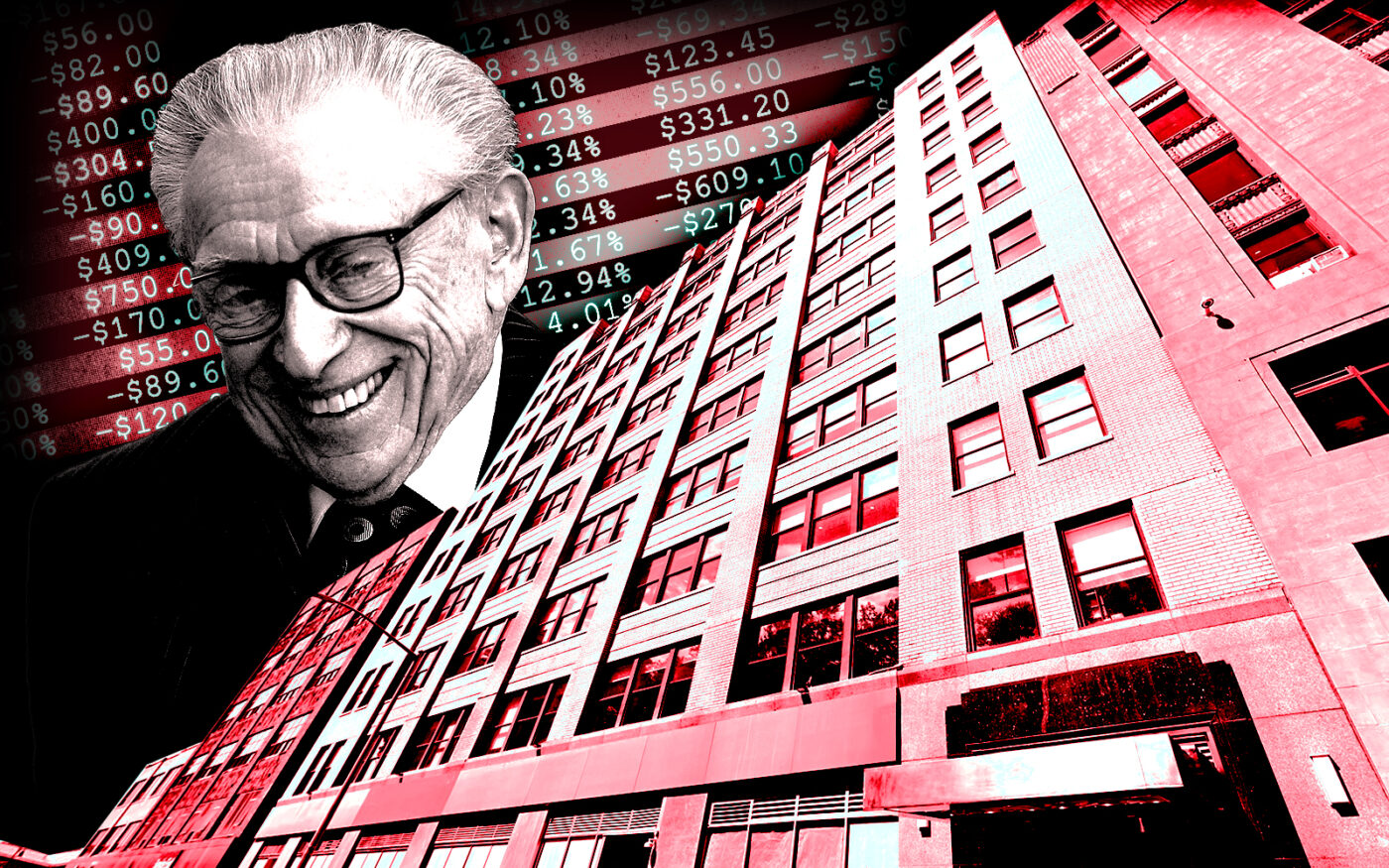

Silverstein Properties’ Larry Silverstein and 619 West 54th Street (Getty, Google Maps)

Trying to capitalize on the high-flying status of New York City’s life sciences market, Silverstein Properties is selling its majority stake in its Far West Side property.

Larry Silverstein’s firm tapped Eastdil Secured’s Gary Phillips and Will Silverman to market its interest in the Hudson Research Center at 619 West 54th Street, the Commercial Observer reported. A buyer could either recapitalize and join up with minority owner Taconic Partners’ life sciences subsidiary or purchase the property outright in a fee simple sale.

The 318,000-square-foot property counts Rensselaer Polytechnic Institute and C16 Biosciences, a Bill Gates–backed startup, among its tenants. The owners continue to invest in a life sciences future for the former office property, recently converting three floors from offices to wet labs.

Taconic purchased the 10-story office building — formerly known as The Movie Lab Building because of Warner Bros. Pictures’ occupancy — for $112 million in 2012. Five years later, Silverstein bought a majority stake, valuing the property at more than $180 million; Taconic retained a 10 percent interest.

The life sciences push began in earnest after Silverstein jumped in. The partners invested $20 million to revamp the building, aiming to bring in research and pharmaceutical tenants. The property marked Silverstein’s first life sciences project.

Read more

Silverstein buys majority stake in Taconic’s 619 West 54th

Silverstein buys majority stake in Taconic’s 619 West 54th

RPI signs at Taconic and Silverstein’s life sciences hub

RPI signs at Taconic and Silverstein’s life sciences hub

NYC life sciences notched second record year in 2022

NYC life sciences notched second record year in 2022

In 2020, Silverstein and Taconic refinanced the property with $205 million from Affinius Capital, then known as Square Mile Capital. Ownership has invested roughly $57 million from the five-year, floating-rate bridge loan to upgrade infrastructure, construct laboratory tenant fit-outs and make other upgrades.

New York City’s life sciences sector enjoyed a record 2022, when tenants leased 455,000 square feet, according to CBRE. It was the second consecutive year of leasing activity topping 400,000 square feet, up 5 percent from the previous year. The average rent record for the sector also fell, coming in at $108.47 per square foot.

— Holden Walter-Warner