Madison Realty sells $44M loan on PS 64 site to mysterious LLC

Madison Realty sells $44M loan on PS 64 site to mysterious LLC

Trending

Here are NYC’s biggest real estate loans from August, September

Big multifamily projects get construction-debt refinancing

New York City’s 10 biggest real estate loans in August and September totaled $1.4 billion this year, down from $2.2 billion last year. The financing, split between Manhattan and the outer boroughs, largely went to big multifamily projects that were rolling over their construction debt.

A pair of hotels and commercial properties also received big loans. Here are the details.

Zell’s angels | Lincoln Center, Manhattan | $263M

The Dermot Company, along with partners Affinius Capital and PGGM, refinanced a 498-unit multifamily building, at 101 West End Avenue in Lincoln Center, with $263 million from Global Atlantic Financial Group. The August loan replaces debt from German lender Helaba, a.k.a. Landesbank Hessen-Thüringen, which provided a $260 million acquisition loan in 2018.

Sam Zell’s Equity Residential sold the building, built in 1999, for $416 million. Investment giant KKR is the majority owner of the new lender, Global Atlantic.

Botanic building | Crown Heights, Brooklyn | $233M

Carmel Partners can move ahead with a 569-unit multifamily building at 54 Crown Street after landing $233 million in construction financing from Goldman Sachs in August. Plans call for a 17-story building with 395,000 square feet near the Botanic Garden.

San Francisco-based Carmel is also building 206 units on the Upper East Side (see below) and 938 units in Long Island City. Goldman Sachs has been looking to sell other portions of its commercial real estate loans.

The convert | Financial District, Manhattan | $220M

After more than a year in contract, Silverstein Properties and Metro Loft Management closed on their acquisition of 55 Broad Street. Mexico’s Banco Inbursa provided the developers $220 million in August to buy and convert the 410,000-square-foot building into 571 market-rate apartments, which would be one of the city’s largest conversions. Ares Real Estate is an equity partner in the project.

The Rudin family sold the 30-story building for $172.5 million, a 4 percent discount from the contract price, and retained an equity stake. Designed by Emery Roth & Sons, 55 Broad Street was Goldman Sachs’ headquarters until 1983. CetraRuddy Architecture will design the conversion.

Deadline dash | Upper East Side, Manhattan | $153M

Carmel Partners received $153 million from Milwaukee-based Northwestern Mutual in September to build a 37-story, 245,000-square-foot multifamily tower at 1487 First Avenue. The developer plans 206 units, records show. Forty-five apartments will be income-restricted, according to loan documents. Completion is expected by June 2026, the deadline to receive the 421a tax abatement. Carmel bought the site in 2022 for $73.5 million, or about $300 per square foot.

Cash-in refi | Midtown East, Manhattan | $150M

To refinance the 774-key Westin Grand Central hotel, Davidson Kempner Capital Management borrowed $150 million in August from Apollo Global Management. Davidson Kempner paid down $63 million in principal on $197 million of short-term, floating-rate debt provided by Goldman Sachs in 2019. That year, Davidson Kempner bought the 520,000-square-foot hotel for $300 million and later renovated it.

Clipper ship | Crown Heights, Brooklyn | $123M

David Bistricer’s Clipper Equity can build a 240-unit multifamily project at 953 Dean Street after securing $123 million in August from a consortium of lenders: Valley National Bank, Bank Leumi, Bank Mizrahi-Tefahot and Be Aviv.

Bank Leumi provided a $30 million acquisition loan last year that helped the developer piece together the assemblage. The new rental building will span 247,000 square feet; 30 percent of units will be income-restricted. Clipper Equity is a real estate investment trust.

Fortuna’s fortune | Midtown South, Manhattan | $120M

Morris Moinian’s Fortuna Realty Group refinanced construction debt on the 300-key Grayson hotel, at 30 West 39th Street in Midtown South, with $120 million in August from Deutsche Bank.

The hotel opened its doors late last year under Hyatt’s Unbound brand after Moinian spent years assembling development rights. The 27-story building spans 130,000 square feet and has an alternative address of 19 West 38th Street. The funds include a new $4 million loan; Goldman Sachs was the prior lender.

Anchor foods | Williamsburg, Brooklyn | $90M

Aurora Capital Associates, Joseph Cayre’s Midtown Equities, and Achs Management refinanced a 123,000-square-foot commercial building at 240 Bedford Avenue in Williamsburg, with $90 million in September from Apollo Global Management.

Whole Foods anchors the property. Other tenants include Equinox, Chipotle, Citibank and T-Mobile. Apollo’s loan replaces debt held by Wells Fargo. The trio of investors bought the property in 2012 for $21 million, or about $170 per square foot, before developing the existing structure.

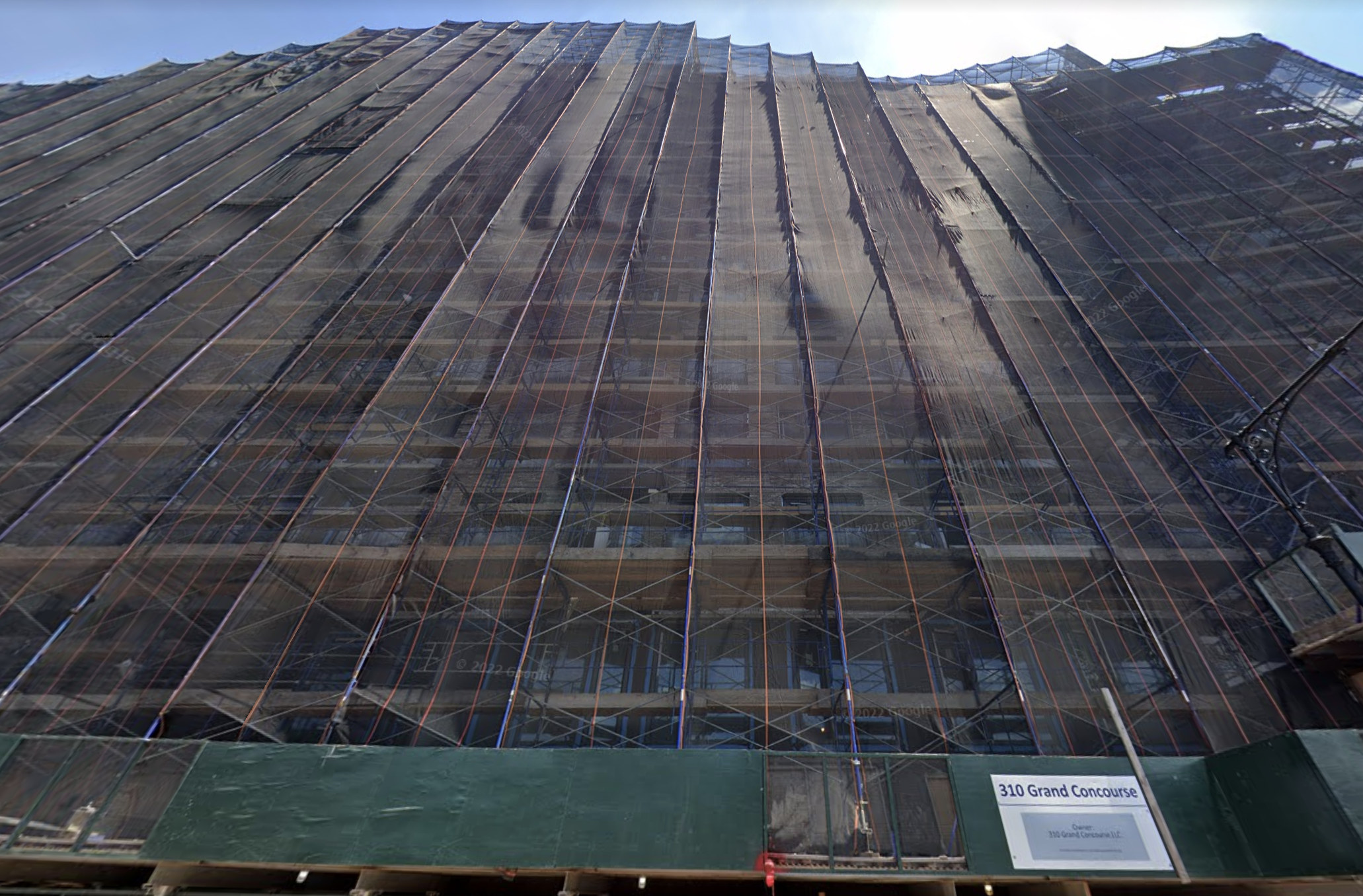

Construction rollover | Mott Haven, the Bronx | $63M

In September, Simon Kaufman’s YS Developers refinanced a 150-unit multifamily project at 310 Grand Concourse in Mott Haven with $63 million from Greystone. The funds replace construction debt from Slate Property Group’s Scale Lending. The building was completed this year. One-bedrooms list for $2,400 to $3,450 and two-bedrooms for up to $4,500. Jacob Schwimmer’s JCS Realty bought the project site in 2018 for $9.5 million.

Storage stuff | College Point, Queens | $59M

GLP Capital Partners refinanced construction debt in September on a 130,000-square-foot, self-storage building at 131-21 14th Avenue in College Point with $59 million from KKR. The loan includes $30 million in new funds. KKR replaces Valley National Bank as the lender. Insite Property Group, a self-storage developer, bought the site in 2021 for $15 million. GLP announced it had raised $1.5 billion for self-storage investment in 2022.

Read more

Madison Realty sells $44M loan on PS 64 site to mysterious LLC

Madison Realty sells $44M loan on PS 64 site to mysterious LLC

Highline launches $350M distressed commercial real estate fund

Highline launches $350M distressed commercial real estate fund

Real estate powerhouses missing from magazine’s vaunted list

Real estate powerhouses missing from magazine’s vaunted list