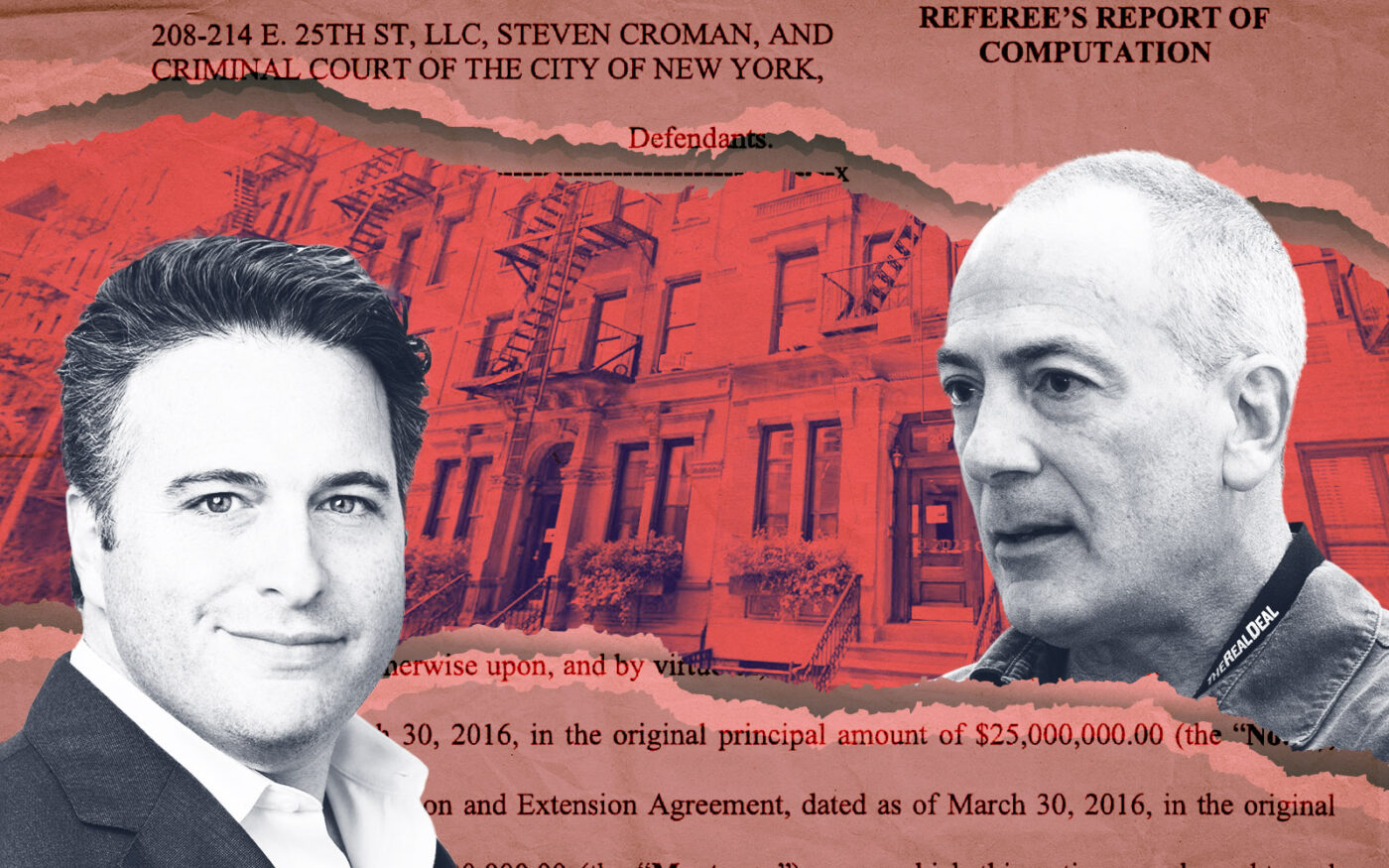

Battle of the baddies: Maverick tries to foreclose on Steve Croman buildings

Battle of the baddies: Maverick tries to foreclose on Steve Croman buildings

Trending

Croman owes $35M on $23M loan after Maverick foreclosure

Landlord calls lender a “bully in the schoolyard”

Three years, two defaults and one bankruptcy “ploy” later, lender Maverick Real Estate Partners finally nabbed a judgment in its foreclosure battle against notorious landlord Steve Croman.

Croman is on the hook for $35 million after defaulting on a $23 million loan backed by four multifamily properties, 208-214 East 25th Street in Kips Bay. a court-appointed referee determined Friday.

That extra $13 million owed largely stems from the 24 percent default interest rate Maverick tacked on when it acquired the loan from Croman’s original lender Miami-based BankUnited.

Croman’s loan will continue to accrue interest at $15,400 per day until the debt is satisfied, according to the court filing.

Maverick, a distressed debt player, earned its aggressive reputation by charging interest just shy of New York’s legal limit. Croman has previously called the firm a “the bully in the schoolyard.”

Neither Croman nor Maverick’s attorney responded to requests for comment.

The recent judgment winds down a three-year saga between the landlord and his lender.

The dispute kicked off in the summer of 2021 after Croman twice defaulted on the debt collateralized by the Kips Bay properties. Maverick scooped up the note, then sued to foreclose the next day.

Croman tried to delay the process by filing for Chapter 11 bankruptcy in December 2022. He claimed he had fallen “victim to predatory lending” when BankUnited accelerated his debt and sold the loan to Maverick after “modest” shortfalls arose.

Maverick, he alleged, then rejected his monthly interest payments — installments made at a non-default rate — to jack up his debt.

Last April, a judge tossed Croman’s bankruptcy case, ruling the suit was a ploy filed in “bad faith” as Croman had “no reasonable probability of emerging from the bankruptcy.”

In July 2023, a judge ruled Maverick could barrel ahead with its foreclosure. In response, Croman’s attorney, Terrence Oved, said the team intended to appeal and immediately followed through.

But three months later, Oved resigned, court filings show.

Croman’s loan is non-recourse, according to court documents, meaning Maverick can only recoup what the properties sell for at auction.

Read more

Battle of the baddies: Maverick tries to foreclose on Steve Croman buildings

Battle of the baddies: Maverick tries to foreclose on Steve Croman buildings

Steve Croman: I was duped by predatory lender

Steve Croman: I was duped by predatory lender

Judge calls Croman’s bankruptcy a ploy

Judge calls Croman’s bankruptcy a ploy