iStar-managed REIT signs $620M contract to buy ground lease at L&L’s 425 Park

iStar-managed REIT signs $620M contract to buy ground lease at L&L’s 425 Park

Trending

425 Park Avenue owners land $911M refi

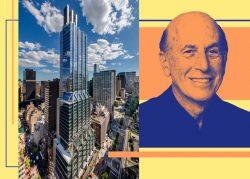

Sumitomo Mitsui Trust Bank led the five-year floating-rate loan

The owners of 425 Park Avenue secured a loan that matches the last package they received at the Midtown Manhattan office tower.

Sumitomo Mitsui Trust Bank led a five-year, floating-rate loan on the 670,000-square-foot property, Bloomberg reported. The $911 million refinancing package will be used to pay off a loan ownership received in 2021, another $911 million debt deal that helped fund construction and completion; that debt package was led by Blackstone Real Estate Debt Strategies.

The 47-story tower was developed by L&L Holding Company, Tokyu Land US Corporation and BentallGreenOak. The developers completed the project in 2022 and have brought leasing up to 90 percent, largely relying on financial and investment firms as tenants.

The anchor tenant is Ken Griffin’s Citadel, which occupies 440,000 square feet across 22 floors.

While financing packages, particularly in the office sector, have been hard to come by due to the rise of remote work and the high-interest rate environment, premium office properties are still finding ways to rise above the challenges.

A few weeks ago, Blackstone landed a $309 million refinancing deal on Park Avenue Tower, though the loan is 27 percent smaller than the last one, suggesting the landlord may be borrowing more from mezzanine lenders than before or kicked in equity to repay the expiring debt.

In a statement regarding 425 Park, L&L president Rob Lapidus cited the market’s “appetite to finance ultra-premium, highly amenitized and well-located office towers owned and operated by first-rate sponsors.”

L&L’s property is situated between 55th and 56th streets. The 897-foot-tall building was the first full-block tower to rise on Park Avenue in nearly 50 years. The project was beset by construction delays and other obstacles, such as the collapse of L&L’s original partner, Lehman Brothers, in 2008.

In 2019, the ground lease on the property was sold to a joint venture between iStar-managed REIT Safehold and an unnamed sovereign wealth fund for $620 million.

Read more

iStar-managed REIT signs $620M contract to buy ground lease at L&L’s 425 Park

iStar-managed REIT signs $620M contract to buy ground lease at L&L’s 425 Park

L&L secures nearly $1B financing package to complete 425 Park Ave

L&L secures nearly $1B financing package to complete 425 Park Ave