Why “smart money” is chasing San Francisco apartments

Why “smart money” is chasing San Francisco apartments

Trending

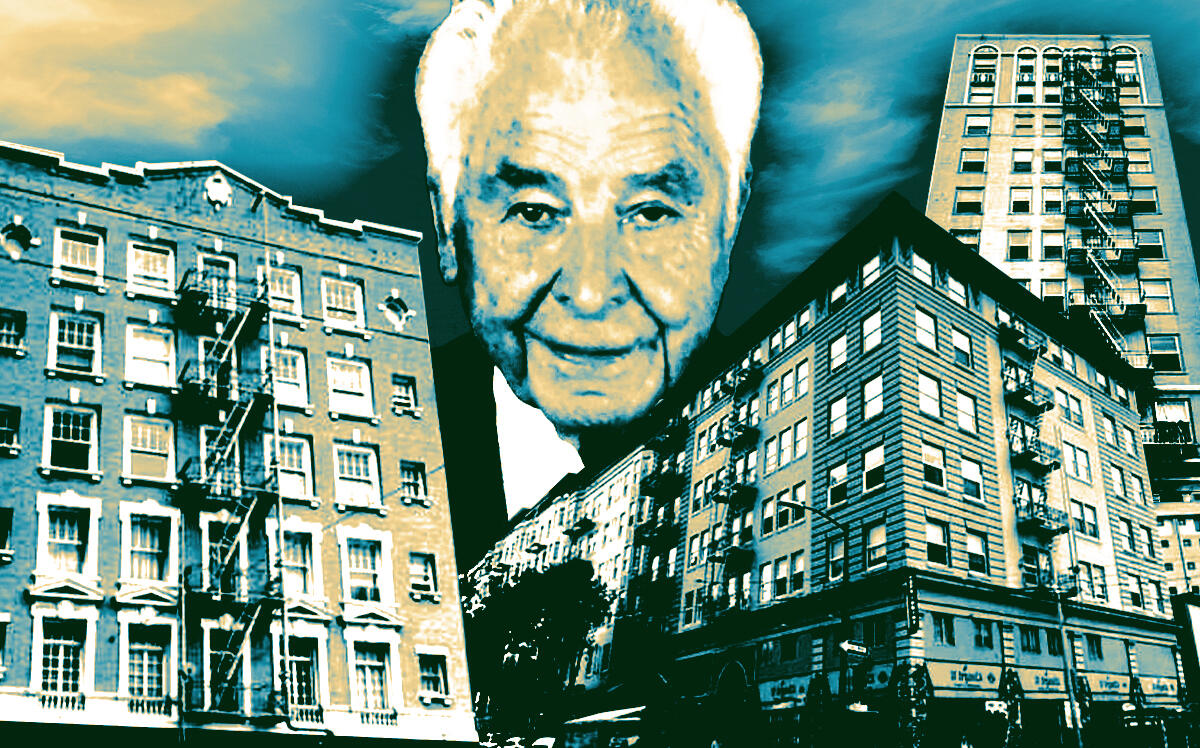

Remnants of Lembi empire list three SF apartment buildings

Entities connected with CitiApartments – which at one time owned 300 rental properties – and Skyline Realty put last assets from 2008 meltdown on the market

Companies connected with San Francisco’s storied Lembi family put three downtown apartment buildings on the market this week.

All the buildings are long-term holds that LLCs connected with the former rental housing juggernaut known as CitiApartments have owned, in some cases, for more than two decades, according to public records. The family has managed to hang on to the assets through their much-publicized defaults after the 2008 financial crisis.

They were listed by Charles Post of Post Real Estate Advisors, who also listed three other Lembi-related properties over the summer. He did not immediately return a request for comment.

All six of the properties were named in an injunction against CitiApartments and its various subsidiaries, settled in 2011, from then-City Attorney Dennis Herrera, for “a stunning array of unlawful business and tenant harassment practices,” according to a press release from his office at the time.

In the injunction, Herrera accused Frank Lembi, son Walter Lembi and nephew David Raynal and the “family’s byzantine array of business entities, trusts and partnerships” of buying up San Francisco apartment buildings, harassing and intimidating long-term rent-controlled tenants into leaving their units, and then renovating them, often without permits, to bring in new market-rate tenants.

“The illegal business model appears to have enabled CitiApartments, Skyline Realty and other entities under the sway of real estate family patriarch Frank Lembi to aggressively outbid competitors for residential properties throughout San Francisco for several years — before lawsuits and a sharp economic downturn forced the aspiring empire into bankruptcies, foreclosures and receiverships,” according to the release announcing the settlement, which included up to $10 million in fines.

At the time of the settlement, CitiApartments had lost about two-thirds of its more than 300 properties with the vast majority of its remaining holdings in receivership. The fee structure the City Attorney’s Office set up depended on how many buildings the Lembis were able to maintain. The damages would be limited to $1 million, plus interest, if the Lembis agreed “to forever cease property management” in San Francisco, an “unprecedented stipulated provision,” according to the release.

The Lembis evidently decided not to take the city up on its offer to leave town and a 2013 debt restructuring allowed its subsidiaries to hold onto at least six properties, according to a filing from the city at the time. With the three downtown buildings listing this week, all six are now on the market.

Three of the smaller buildings came on in July — an 18-unit Marina property, a two-unit with seven parking spaces in the Castro, and a single-story commercial building occupied by a nonprofit in Japantown. The 7,500-square-foot commercial space was listed at $4 million and is the only one of the initial three listed as “under contract” on listing sites. The other two took substantial price drops on Sept. 5, the same day the larger listings came on the market.

The biggest and most expensive of the new listings is 935 Geary Boulevard, a 10-story Tenderloin apartment building known as The President, which is asking just under $16 million or about $135,000 per unit. It has 113 efficiency units with private bathrooms, four studios, one “townhouse-style” one-bedroom, and two office spaces in about 45,000 square feet, according to the listing notes. It is 30 percent vacant, with some units in the 1923 property that “will require renovations prior to renting” and an average rent of $500 a month.

In SoMa, the six-story 1912 building at 77 9th Street is 95 percent filled, according to its listing notes. It has 43 studios, each with its own private bathroom and kitchen, which rent for an average of $1,500 a month; a one-room SRO-style apartment with a hall bathroom and no kitchen; and 10 one-bedroom apartments that rent for an average of $1,800 a month. The 23,000-square-foot building is listed for just under $10 million, or $185,000 per unit.

Another Tenderloin building, this one at 500-510 Larkin Street, is asking about the same price per unit for nearly double the square footage, though much of that additional space is utilized by a three-story bar and event space with a dedicated outdoor patio. The corner building is six stories with 43 studio apartments, nine one-bedroom apartments, one two-bedroom apartment that “needs upgrading” and a commercial storefront currently leased to an organic grocer. Of the three buildings, it is the most recent buy, purchased for $6.5 million in 2004.

Many long-time owners have begun selling off their apartment buildings in the city as rents are back up from pandemic lows, with some northern neighborhoods closing in on their pre-pandemic rates. The $18 million sale of a long-held trophy building overlooking Alamo Square is the biggest multifamily sale of 2022 thus far.

Read more

Why “smart money” is chasing San Francisco apartments

Why “smart money” is chasing San Francisco apartments

Winners, losers in San Francisco’s rental recovery

Winners, losers in San Francisco’s rental recovery

SF’s priciest multifamily sale this year totals $18M

SF’s priciest multifamily sale this year totals $18M