Trending

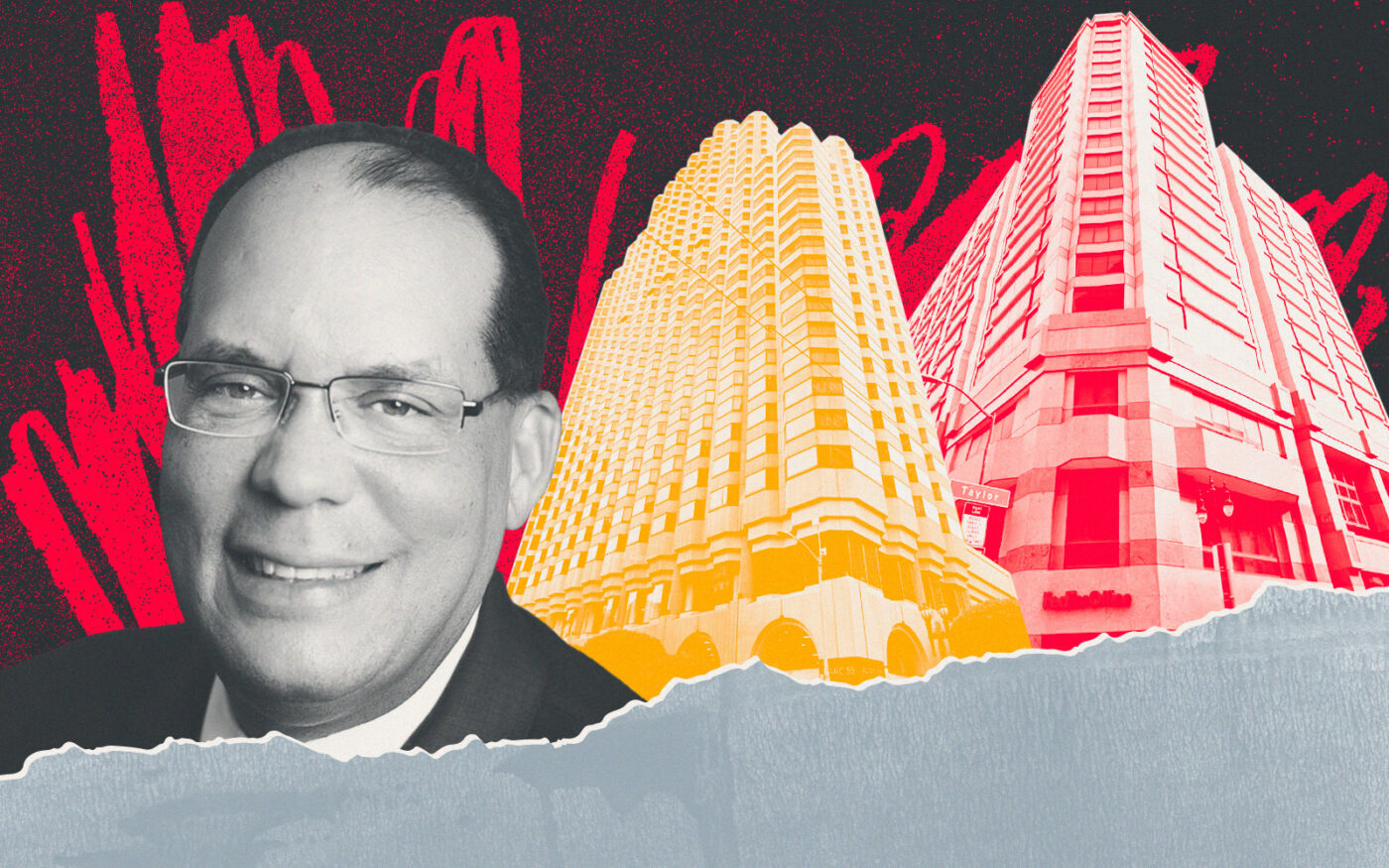

Park Hotels has “no appetite” for workout of $725M loan on SF hotels

REIT stopped payments on Hilton San Francisco and Parc 55 debt in June

Two months after ceasing payments on a $725 million loan tied to two San Francisco hotels, Park Hotels & Resorts seems ready to give up the properties.

THe Virginia-based lodging real estate investment trust has “no appetite” for a workout “of any kind” on the commercial mortgage-backed securities loan, according to comments from the special servicer on the deal provided by Trepp.

“Discussions with the borrower have not been productive,” the special servicer said in July comments, adding foreclosure of both hotels was likely.

The special servicer has asked for an appraisal — when the loan was issued in 2016, the hotels were collectively valued at $1.56 billion, according to Morningstar Credit Analytics.

In June, Park said it would stop servicing the debt, which is backed by the 1,921-key Hilton San Francisco Union Square and the 1,024-key Parc 55 San Francisco. They represent the first and fourth largest hotels, respectively, by room count in the city.

The fixed-rate loan was set to mature in November.

Both hotels bled cash in 2020 and 2021 as a result of COVID-19-related closures. And Park was never able to bring the hotels back to profitability — cash flow was still negative for the 12 months ending in September 2022, according to DBRS Morningstar.

In February, Morningstar noted the hotels were continuing to face challenges, even though Park was “continuing to support the loan by funding shortfalls out of pocket and keeping the

loan current.”

“Ultimately removing the loan and the hotels will substantially improve our balance sheet,” the firm said in June.

Workouts come in various shapes and sizes — some delinquent borrowers have chosen to hand back the keys, while other CMBS lenders have chosen to pursue a receivership, where a third-party is tasked with improving revenues or marketing the property for sale.