Park Hotels in deal to sell Hilton Garden Inn near LAX

Park Hotels in deal to sell Hilton Garden Inn near LAX

Trending

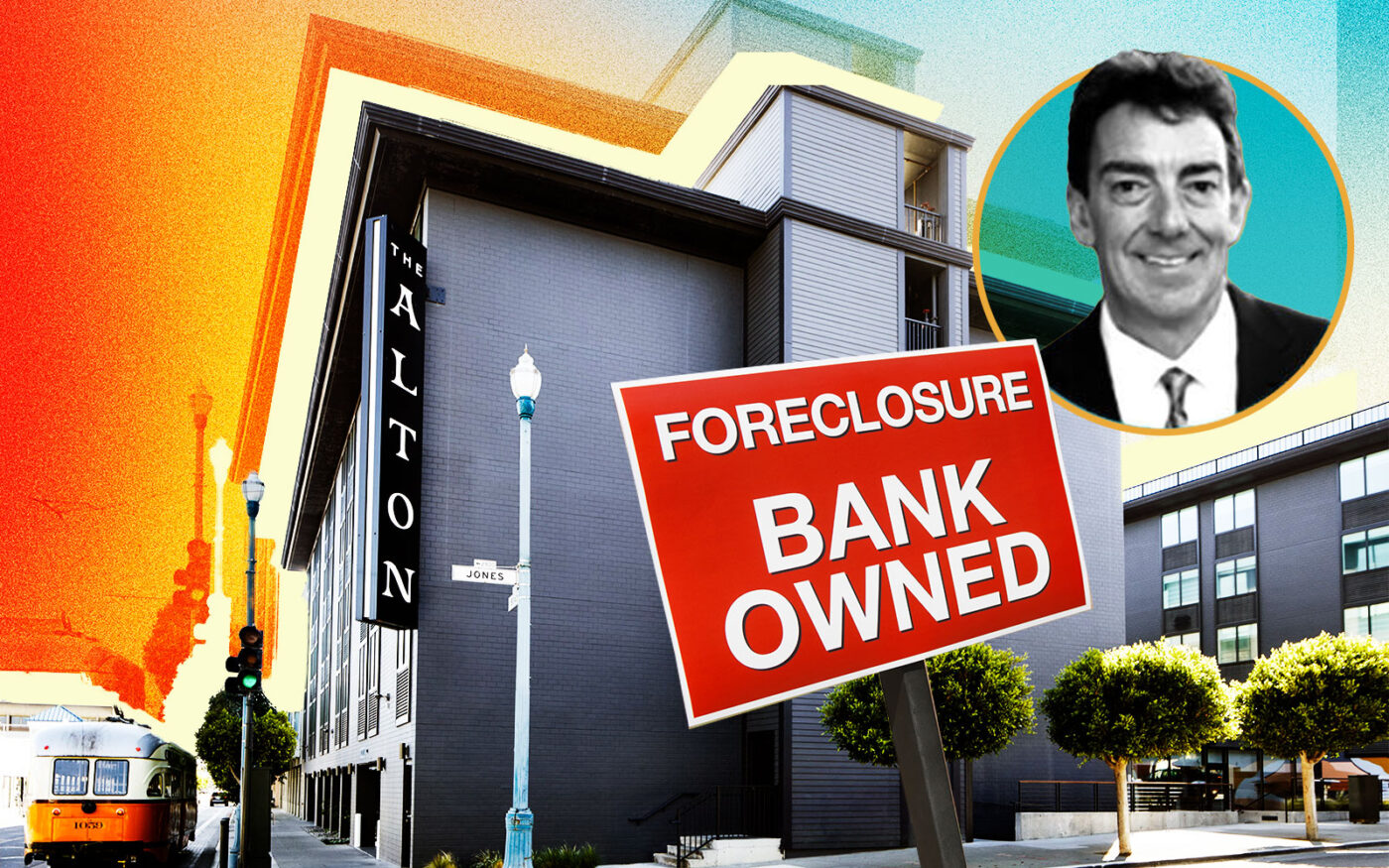

DiNapoli Capital forfeits Kimpton Alton hotel on SF’s Fisherman’s Wharf

Investor hands keys to lenders of $85M mortgage in lieu of foreclosure

DiNapoli Capital Partners has handed the keys to the Kimpton Alton Fisherman’s Wharf to the lender of its $85 million mortgage.

An affiliate of the Walnut Creek-based investor led by F. Matthew DiNapoli surrendered the 248-room tourist hotel at 2700 Jones Street, the San Francisco Business Times reported.

The lender, a Minneapolis-based affiliate of AB CarVal Investors, had joined Ramsfield Hospitality Finance in March 2022 to provide the $85 million loan.

The amount of unpaid debt and associated costs is more than $88.1 million, according to a deed in lieu of foreclosure filed in San Francisco. It’s not clear if the loan was delinquent.

If CarVal lands a buyer for DiNapoli’s debt, it could transfer ownership without needing to pay the city’s high property transfer tax, according to the Business Times.

The Dinapoli affiliate bought the hotel a block from the waterfront in 2018 for $44.8 million, or $180,645 per room.

Kimpton, the locally based unit of InterContinental Hotels Group, took over as hotel manager in spring 2021 after a renovation. The hotel occupancy rate was not disclosed. Rooms this week ran from $203 to $536 a night, according to the hotel’s website.

The hotel is anchored by Michelin Guide-honored restaurant Abacá, a Filipino-Californian restaurant from San Francisco chef Francis Ang, known for its longganisa-style pork skewers and original pastries.

The Kimpton Alton takes up half of the former 585-room, two-building Holiday Inn at Fisherman’s Wharf. Westbrook Partners bought the hotel in 2017 and then sold the Beach Street half to DiNapoli, turning the other half across Jones Street into Hotel Caza.

DiNapoli Capital Partners, founded in 2005 by DiNapoli, Matthew Campbell and Chuck Bond, has bought or sold more than $7 billion in commercial, multifamily, office and senior housing properties, according to its website.

It owns 10 hotels in Washington, Oregon, Colorado, Texas, Louisiana, Virginia and California, including the 140-room Hotel Triton at 342 Grant Avenue in San Francisco, and hotels in Palm Springs and Orange.

In 2022, an affiliate based at the same address of DiNapoli bought a 162-key Hilton Garden Inn in El Segundo near Los Angeles International Airport for an undisclosed price, The Real Deal reported. The hotel is not listed on the company’s website.

At the same time, DiNapoli sold a portfolio of more than 1,000 apartments in Nevada, Arizona and New Mexico to Beverly Hills-based Kennedy Wilson for $418 million.

— Dana Bartholomew

Read more

Park Hotels in deal to sell Hilton Garden Inn near LAX

Park Hotels in deal to sell Hilton Garden Inn near LAX

EOS Investors identified as buyer for Hotel Zoe Fisherman’s Wharf

EOS Investors identified as buyer for Hotel Zoe Fisherman’s Wharf

BH Properties to renovate Anchorage Square on SF’s Fisherman’s Wharf

BH Properties to renovate Anchorage Square on SF’s Fisherman’s Wharf