City unveils its own version of 421a subsidy

City unveils its own version of 421a subsidy

Trending

Progressive lawmakers float property tax break

Lander, Kavanagh mull solutions to housing shortage

For years, New York’s troubled property tax system has failed to galvanize elected officials to do anything more than create task forces.

Now, two lawmakers are hoping to bite off a chunk of the seemingly insurmountable problem.

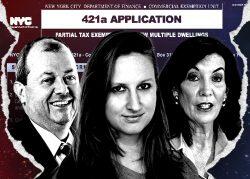

City Comptroller Brad Lander is proposing to reduce the tax rate for newly constructed multifamily housing. And state Sen. Brian Kavanagh, who chairs his chamber’s housing committee, said he is planning to work with Lander on legislation to create parity between rental and condo taxes.

A 2021 report analyzing the city’s tax system found that rental projects with more than 10 units were taxed at nearly double the rate of condos.

Ideally, Lander’s change would be part of broader property tax reform, but the comptroller acknowledged, “It does not appear that there is political appetite or bandwidth to confront it.”

A new tax class with a lower rate for large, multifamily projects, however, would reduce the need to provide a special tax break, such as the expired 421a, he said.

“This is to solve one particular problem,” he said. “In my opinion, it is a much more rational solution to a problem that 421a is trying to solve.”

Lander’s office estimates that the tax class he is proposing would reduce property taxes for large, new rental buildings by 30 percent.

The proposal is not new, but could gain new life next year if pressure builds on elected officials to get multifamily construction going again.

Lander has no formal power to pass state legislation, which his idea requires, but could have credibility on this issue as the highest-ranked progressive in city government and an outspoken critic of 421a. When moderates or conservatives propose tax breaks for development, they tend to be assailed as giveaways to the real estate industry.

Lander has also floated a replacement property tax break to replace 421a, the expiration of which in June 22 has all but stopped new rental projects.

Lander’s program would not be as-of-right, but rather awarded by the Department of Housing Preservation and Development based on the cost of a project and its affordability levels. Such a discretionary process would also allow the Department of Housing Preservation and Development to account for labor costs.

In one sense, Lander’s proposal would create more certainty for developers than 421a did because the benefit would be decided upfront. Under the expired program, developers did not find out if they qualified for the tax break until construction was complete.

On the other hand, 421a was an as-of-right program. Adding one with an approval process to an agency that has struggled with staff shortages may lead to a project backlog and complicate project financing. Lander acknowledged that capacity at HPD would be critical.

The Real Estate Board of New York does not support making the tax break discretionary. But the group struck a neutral note when asked about Lander’s proposal.

“We welcome the comptroller’s focus on the need to find ways to create more rental housing in New York City,” a spokesperson for the group said in a statement. “We look forward to reviewing this proposal in more detail.”

Kavanagh is open to the 421a alternative.

“It is a very different way of thinking about 421a,” Kavanagh said. “It might be something that you do in addition to a more traditional 421a approach.”

He said an as-of-right route could be reserved for projects that meet certain affordability criteria and that construction wage requirements. Other projects would need to go through HPD.

The Adams administration announced plans Monday for its own discretionary program. The Mixed Income Market Initiative, or MIMI, would provide city subsidies to housing projects where 70 percent of the units are income-restricted, including 15 percent for formerly homeless individuals.

It is unclear how much money is available for the program or whether it will get buy-in from the industry.

Democratic lawmakers have said they are hopeful of reaching a housing deal next year that includes a property tax incentive for housing and new eviction protections. Gov. Kathy Hochul has not supported good cause eviction, but has indicated she is open to a housing package that includes tenant protections. The state legislative session starts Jan. 3 and ends June 6.

Read more

City unveils its own version of 421a subsidy

City unveils its own version of 421a subsidy

The truth about 421a

The truth about 421a

Hochul signs rent bill that landlords call “disaster”

Hochul signs rent bill that landlords call “disaster”