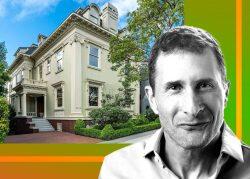

BYOE as Safegraph CEO list Pacific Heights mansion for $14.5M

BYOE as Safegraph CEO list Pacific Heights mansion for $14.5M

Trending

SafeGraph CEO Auren Hoffman sells Pac Heights mansion for $9M

Price marks $3M drop since purchase in 2015, but still ranks in SF’s top deals

SafeGraph CEO Auren Hoffman has sold his Pacific Heights home for $9 million — a price $3 million less than he paid it for in 2015, according to public records.

The buyer was Lee Wittlinger, managing director of Menlo Park-based tech investment firm Silver Lake, and his wife Gwendolyn, according to public records.

Located at 3015 Pacific Avenue, the six-bedroom, 6.5-bath built in 1912 was originally listed in April 2022 for $14.5 million and has the unique features of an elevator shaft, but no actual elevator, and a wine cellar hidden behind a vintage bank safe door.

The asking price on the 7,400-square-foot home dropped to $12 million one month after it first listed and later went off the market. When it reappeared in the fall of 2023, it had undergone a massive price cut to $8.5 million, and when it returned once again in February of this year it was down to an even $8 million.

The final price cut combined with what is shaping up to be a more robust market this spring seems to have done the trick, as the home went into contract on March 8. It sold for $1 million more than its most recent asking price on March 14, according to public records. The quick close is a strong indicator of an all-cash deal.

The sale calculates to about $1,200 per square foot, compared to $1,600 per square foot that Hoffman paid nearly a decade ago.

Ted Bartlett and Tina Bartlett Hinckley at Compass were the listing agents when the home first came to market two years ago and listed the home this year as well. They declined to comment on the sale.

The buyer’s agent was Monica Pauli, also with Compass. She also declined to comment.

Even at nearly 40 percent off the original asking price, the sale is among the top deals in San Francisco so far this year. The fact that it sold over the most recent ask means there was likely competition on the home, a situation that it appears did not exist last fall.

The percentage of San Francisco homes selling over list price was up 28 percent in February 2024, compared with the year prior, and about half of all home sales in the city were over asking last month, according to a recent Compass report. Homes in the city sold for an average of 8 percent over list price in February.

That’s far less than at the height of the market in the spring of 2022, when the home first listed and single-families in the city went for an average of about 25 percent over list, with three out of four homes selling above their asking price. But it is one of several key indicators that this spring will mark a new beginning for the residential market in the city, according to Compass data.

Sales volume was up 32 percent in February compared to the same month last year and the number of new listings was up about 11 percent. The number of sales over $3 million was up 60 percent in January and February compared with one year ago, and homes over the $5 million mark are up as well, though sales at that higher price point are still occuring at a rate of 10 or fewer per month.

The biggest single-family San Francisco sale thus far this year was the late January $14.5 million trade for a Sea Cliff home owned by SF Examiner owner Clint Reilly and also listed by Ted Bartlett and Tina Bartlett Hinckley.

The biggest sale overall in the city in 2024 is a co-op penthouse at 2000 Washington that sold for $16 million — the same price it got the last time it sold in 2014. The listing agent on that property, Sotheby’s agent Gregg Lynn, is also listing the penthouse at 2006 Washington down the street. It currently has the highest asking price in the city at $35 million.

Hoffman is a serial entrepreneur who heads SafeGraph, a company that aggregates location data from mobile phones. As an angel investor he holds stakes in a number of tech companies.

Read more

BYOE as Safegraph CEO list Pacific Heights mansion for $14.5M

BYOE as Safegraph CEO list Pacific Heights mansion for $14.5M

SF Examiner owner sells Sea Cliff house for $14.5M, keeps home next door

SF Examiner owner sells Sea Cliff house for $14.5M, keeps home next door

Pacific Heights penthouse sells for $16M, same as 2014 price

Pacific Heights penthouse sells for $16M, same as 2014 price